Google statistics 2026: the data defining your growth

Last Updated on 21 January 2026 by Dorian Menard

The essential takeaway: Google operates as a massive $349.8 billion ecosystem, not just a search engine. Mastering this interconnected network of Search, YouTube, and Cloud is the primary driver for digital visibility and commercial success. With an 82.3% market share, it remains the undisputed gatekeeper of the online economy.

Are you still optimizing your strategy for a search landscape that no longer exists, or are you ready to align your budget with the actual flow of global digital revenue?

This analysis of Google statistics 2026 exposes the raw numbers behind Alphabet’s empire, separating the dying traffic sources from the explosive growth of Cloud infrastructure and AI-driven discovery.

You will walk away with a clear understanding of the financial engines powering the web and the specific data points required to secure your market share in this volatile environment.

- Google’s Footprint: The Ecosystem in One View

- Search and Browser Dominance: The Core of the Empire

- The Mobile and Media Fronts: Android, iOS, and YouTube

- The Business Engines: Ads, Local Discovery, and Cloud

- The Next Chapter: AI, Australia Focus, and Our Data

Google’s Footprint: The Ecosystem in One View

The Financial Engine: Where the Money Comes From

Alphabet pulled in a staggering $349.8 billion in 2024 revenue. It is a cash machine, yet the mix is shifting. The heartbeat remains Google Search Ads, generating $198 billion alone. YouTube Ads added $36.1 billion, while AdSense contributed $30.3 billion.

Advertising still pays the majority of the bills. But watch Google Cloud, which surged to $43.2 billion—their fastest-growing hedge against ad volatility.

The Billion-User Club: Google’s Product Reach

Google’s real power isn’t just in the bank balance; it is in your pocket daily. They own the utilities of the modern internet. The roster is undeniable: Google Search claims 4.3 billion users, followed by Chrome at 3.5 billion.

YouTube holds 2.7 billion, Google Maps guides 2 billion, and Gmail connects 1.8 billion. This creates a captive ecosystem where every product reinforces the others, securing their data dominance.

Google in 60 Seconds: The 2026 Snapshot

Need the headlines fast? Here is the cheat sheet for the numbers that actually matter. We stripped away the noise, pulling these figures directly from Alphabet’s latest financial filings. This snapshot reveals the sheer scale of the operation as we look toward Google statistics 2026 projections.

| Metric | Value | Primary Source |

|---|---|---|

| Total Revenue | $349.8 Billion | Alphabet SEC Filings |

| Net Income | $100.1 Billion | Alphabet SEC Filings |

| Search Ad Revenue | $198 Billion | Alphabet SEC Filings |

| Google Cloud Revenue | $43.2 Billion | Alphabet SEC Filings |

| Daily Searches | 10.8+ Billion | Estimated from official statements |

| Chrome Users | 3.5+ Billion | Company Announcements |

| YouTube Users | 2.7+ Billion | Company Announcements |

| Google Maps Users | 2.0+ Billion | Company Announcements |

Search and Browser Dominance: The Core of the Empire

Now that the big picture is set, let’s look at how the historic heart of the empire, search, maintains its near-total dominance.

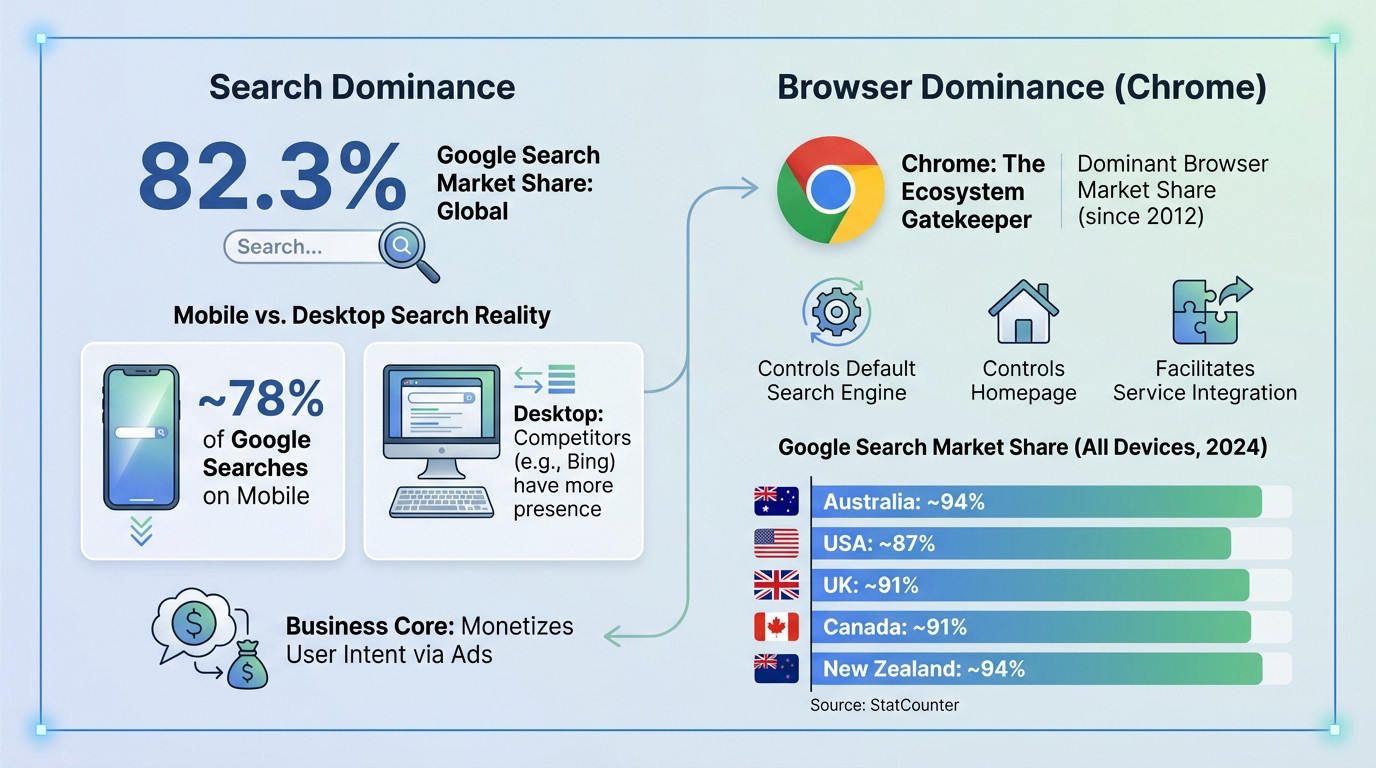

Google’s Near-Total Hold on Search

Google isn’t just a participant in the digital economy; it effectively owns the board. Globally, the search giant commands a staggering 82.3% market share. That is not just a lead; it is a monopoly in everything but legal name.

Down Under, the grip is even tighter. Australia‘s search engine usage statistics show a relentless stability, hovering near 94% according to StatCounter. If you are targeting Aussie customers, ignoring Google is essentially financial suicide.

This dominance fuels the entire ad machine. It is exactly where user intent gets captured, packaged, and sold back to businesses like yours.

The Desktop vs. Mobile Reality

Yet, that global number hides a critical split. The real war for attention happens in your pocket, not on your desk.

Roughly 78% of Google searches now happen on mobile devices. This is where the competition is fiercest and where local intent drives actual phone calls to your business.

On desktop, Google’s grip loosens slightly. Why? Because Bing comes pre-installed on Windows PCs, artificially inflating Microsoft’s share in corporate environments where users rarely change defaults.

Chrome: The Silent Gatekeeper

Stop thinking of Chrome as just a browser. It is a massive massive distribution tool designed to keep you locked inside the Google ecosystem.

Dominating since 2012, Chrome controls the default search engine and homepage for billions of users. By owning the browser, Google dictates the rules of the road before you even make a single search query.

- Australia: ~94%

- USA: ~87%

- UK: ~91%

- Canada: ~91%

- New Zealand: ~94%

(Source: StatCounter)

The Mobile and Media Fronts: Android, iOS, and YouTube

Beyond the browser, the battle for dominance plays out in our pockets and across our screens through mobile operating systems and content platforms.

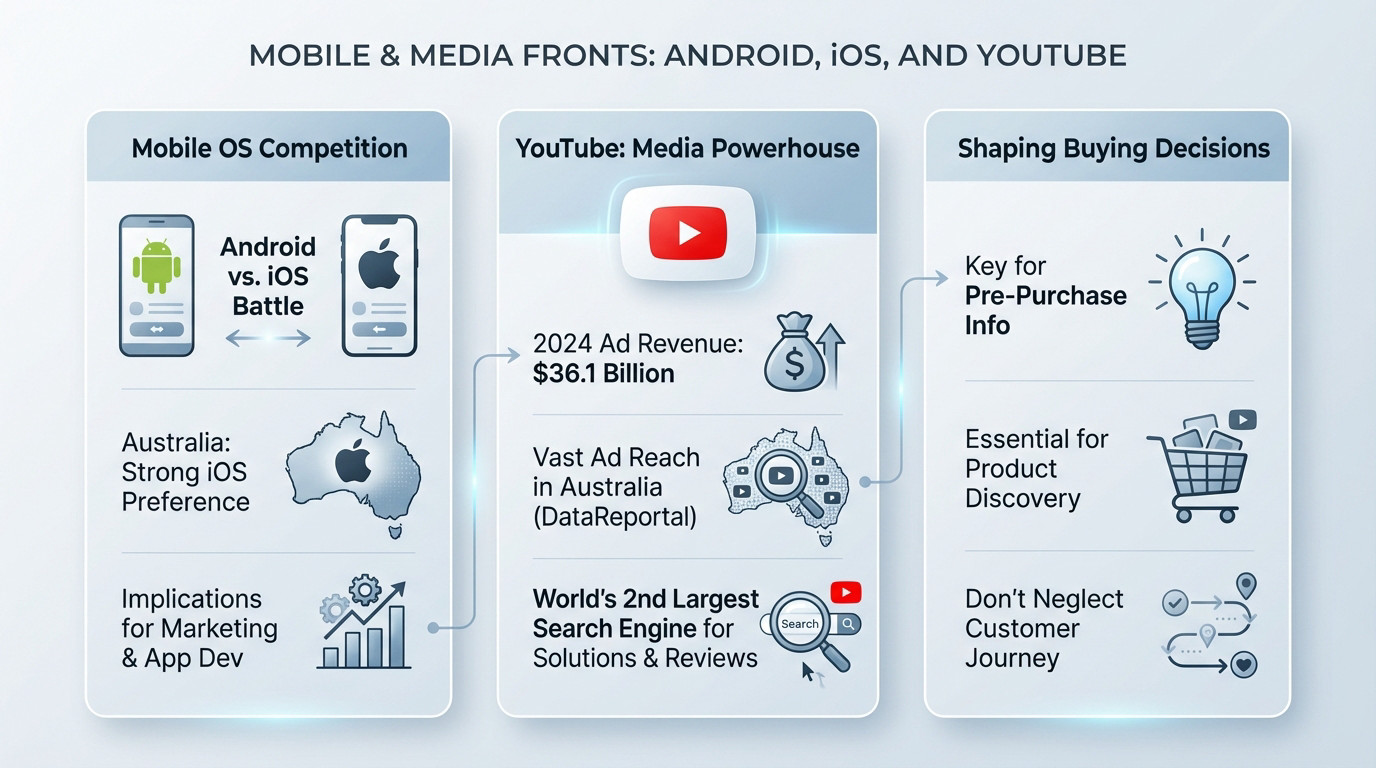

The Mobile OS Battlefield in Australia

Everyone assumes Google owns the mobile world. But looking at the Google statistics 2026 data, the armor has cracks; the Android versus iOS fight is rarely a clean sweep.

Australia tells a different story than the global average. Here, the market leans heavily toward Apple, with iOS capturing nearly 59% of the share by late 2025, leaving Android trailing behind at roughly 40%.

This specific duality dictates your budget; ignoring one platform here means missing nearly half your local audience.

YouTube’s Media Empire

YouTube stands as the absolute crown jewel of Google’s media holdings, driving massive engagement beyond simple search.

The numbers prove the scale. YouTube pulled in over $36.1 billion in ad revenue during 2024 alone. While specific 2026 reach data is pending, the trajectory confirms it remains a primary engine for digital visibility.

“YouTube isn’t just for entertainment; it’s the world’s second-largest search engine where your customers are actively looking for solutions, reviews, and how-to guides.”

How YouTube Shapes Buying Decisions

Stop treating this platform like a TV channel; it is a search engine. Your customers aren’t just watching clips; they are actively vetting products before spending a single dollar.

For e-commerce and service brands, showing up here is non-negotiable. Ranking in the feed often drives more qualified intent than a standard text result, effectively turning casual visitors into ready buyers.

If you skip this step, you are voluntarily handing a massive chunk of your customer journey to competitors.

The Business Engines: Ads, Local Discovery, and Cloud

Understanding the ecosystem is one thing. Knowing how it generates revenue and how businesses can leverage it to find customers is another.

The Economics of Google Ads

Let’s be real about where the money comes from. Google Ads remains the undisputed financial engine, with Search Ads alone pumping in over 56% of Alphabet’s total revenue in 2024.

This model works because it monetizes pure intent. You aren’t paying for eyeballs; you pay to appear exactly when a customer asks for your solution. That precision makes the system incredibly resilient.

But throwing money at the algorithm doesn’t guarantee results. Real success comes from expert campaign management that targets profit, not just clicks.

Local Search and Google Maps: Where Customers Are Won

For service businesses like plumbers or lawyers, the real battle happens locally. If you aren’t visible here, you simply don’t exist to neighbors looking for help right now.

With Google Maps holding 60% of the mapping market, the stakes are high. A well-managed Google Business Profile is the key to appearing in the “3-pack” and turning those searches into actual phone calls.

“For a local Perth business, ranking on Google Maps isn’t about ego. It’s about generating qualified leads that fill your appointment book and grow your revenue.”

Google Cloud: The New Growth Frontier

Look beyond ads, and you see Google Cloud emerging as Alphabet’s second major growth engine.

The numbers back this up, showing a massive 31.1% revenue jump between 2023 and 2024. This surge is directly fueled by the explosive corporate demand for robust artificial intelligence infrastructure.

Key Drivers of Google Cloud Growth:

- High demand for AI and machine learning infrastructure.

- Core enterprise platform services (GCP).

- Data analytics and database solutions.

The Next Chapter: AI, Australia Focus, and Our Data

Google’s foundations are solid, yet the future is already being redrawn by AI, while presenting distinct behaviors in markets like Australia.

AI Overviews and the Future of Clicks

Search isn’t just blue links anymore. Google deployed AI Overviews and Gemini to counter the existential threat of chatbots like ChatGPT. It’s a survival move for their ecosystem.

We are still measuring the true fallout. Google now answers queries directly on the SERP, which inevitably steals clicks from websites. Even financial analysts are watching this infrastructure shift closely. The organic click is getting harder to earn.

Panic won’t help you rank, but adaptation will. Your SEO strategy must evolve to survive in this zero-click environment. AI Search Engine Optimisation is the future!

Australia Focus: A Unique Market Snapshot

You cannot rely on global averages to win here. The Australian market behaves differently than the US or UK. Generic stats will lead your local strategy astray.

Google dominates search share here, and Chrome is the browser king. However, mobile usage is heavily split with iOS devices. These numbers are vital for grasping SEO and marketing trends in Australia.

Local nuance is the difference between vanity metrics and revenue. This specific data helps build campaigns that actually convert.

Our Data Promise: Why You Can Trust These Numbers

We don’t guess with your business intelligence. Every statistic here comes from credible sources and verified financial reports. You won’t find circular “blog spam” citations in this list.

- Tier 1: Official Alphabet investor reports & SEC filings.

- Tier 2: Verifiable market share data (e.g., StatCounter).

- Tier 3: Platform reach data from reputable sources (e.g., DataReportal).

- Tier 4: Vetted, high-quality industry research.

We refresh this data constantly to keep it actionable. Last updated: December 2025.

Google’s dominance is clear, but the way users interact with it is shifting fast. For Australian businesses, standing still is not an option. Use these insights to refine your strategy, embrace the AI transition, and turn this massive ecosystem into your most consistent source of revenue.

FAQ

How much revenue did Google generate in 2024?

In 2024, Alphabet (Google’s parent company) generated a massive $349.8 billion in total revenue. The bulk of this cash flow still comes from their advertising machine, with Google Search Ads alone contributing $198 billion to the pot.

While they are diversifying, advertising remains the financial backbone. However, segments like Google Cloud are catching up fast, bringing in $43.2 billion and proving that Google is successfully expanding its income streams beyond just clicks.

What is Google’s search market share in Australia compared to the US?

Google’s dominance varies slightly by region, but it is exceptionally strong in Australia. While Google holds about 87% of the market in the US, its grip in Australia is tighter, sitting at approximately 94%.

For Australian businesses, this means Google isn’t just an option; it is effectively the entire market. Unlike in the US where Bing has a slightly larger foothold on desktop, ignoring Google in Australia means being invisible to the vast majority of your potential customers.

How many people actually use Google products daily?

The scale is staggering. As of 2024, Google Search serves over 4.3 billion users globally, processing roughly 10.8 billion searches every single day. But it’s not just about search; the ecosystem is designed to keep you there.

Chrome is used by 3.5 billion people, and YouTube has 2.7 billion active users. This creates a “walled garden” effect where a single user often interacts with three or four Google products before they even finish their morning coffee.

Is Google Cloud profitable and growing?

Yes, and it is becoming a primary growth engine for Alphabet. In 2024, Google Cloud revenue hit $43.2 billion, driven by a massive 30%+ year-over-year growth rate. This isn’t just storage anymore; it’s heavily fuelled by the demand for AI infrastructure.

While advertising is the steady giant, Cloud is where the explosive growth is happening. Businesses are migrating their data and AI operations to Google’s infrastructure, making this segment critical for the company’s future beyond ad revenue.

What percentage of Google searches are on mobile?

The battle for attention has shifted almost entirely to the phone in your pocket. Approximately 78% of all Google searches now happen on mobile devices. This is where high-intent “near me” searches and immediate buying decisions occur.

If your digital strategy prioritises desktop over mobile, you are effectively ignoring nearly 8 out of 10 potential interactions. The desktop market is still relevant for complex B2B research, but mobile is where the volume—and the immediate action—lives.