The State of SEO and marketing in Australia: 2026 Comprehensive Analysis

Last Updated on 12 February 2026 by Dorian Menard

The Australian digital marketing landscape has undergone a remarkable transformation in 2026. With total SEO industry value reaching $1.5 billion and year-over-year growth of 12%, businesses are investing more heavily in search optimisation than ever before.

This comprehensive analysis combines data from leading industry reports to provide a clear picture of current trends, challenges, and opportunities.

From the continued dominance of Google to the rising influence of voice search and AI, these statistics reveal how Australian businesses are adapting to an increasingly complex digital environment.

Search Engine Market Dominance and Usage Patterns

Core Search Statistics

The Australian search landscape remains one of the most concentrated globally, with Google’s dominance showing no signs of weakening despite regulatory scrutiny and competitor innovations.

This concentration creates both opportunity and risk—businesses that excel in Google’s ecosystem capture massive market share, while those that falter face severe visibility consequences. Understanding this monopolistic environment is crucial for strategic planning.

- As of August 2024, the ACCC reports that Google holds nearly 94% of the general search market in Australia, with Bing at around 4.7% and all other engines making up the small remainder.

- Statcounter data for mid‑2024 to mid‑2025 shows a similar pattern, with Google typically between 92–94% of Australian search engine usage, Bing between 4–6%, and Yahoo/DuckDuckGo/Ecosia each below 2%.

- This concentration has remained stable across recent ACCC and Statcounter reporting, indicating that Google’s dominance in Australian search is “yet to be disrupted”.

- 75% of users never scroll past first page results

Device Usage Transformation

The mobile-first reality has fundamentally altered user expectations and business requirements. Australian consumers now expect instant, location-aware, voice-optimised experiences that traditional desktop-focused strategies simply cannot deliver.

This isn’t just about responsive design—it’s about reimagining how businesses connect with customers in a mobile-dominated world.

- Australia is a strongly mobile-first market.

- Mobile connections equal 126% of the Australian population (DataReportal Digital 2024).

- Around 97% of Australians own a smartphone.

- More than 96% use smartphones to access the internet.

- 96% of people use a smartphone to get things done (Google research).

- 87% turn to search first when a need arises.

- 51% of smartphone users discover a new company or product via mobile search (Think with Google).

For Australian marketers, this means the majority of discovery and comparison moments now happen on mobile devices—even when the final conversion is on desktop or offline.

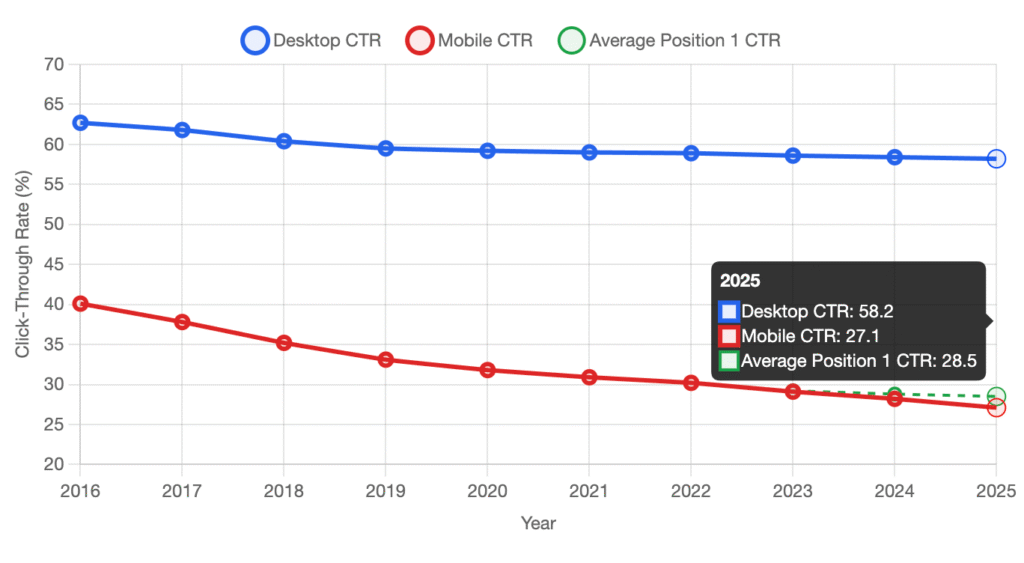

Click-Through Rate Changes

The biggest structural change in search behaviour is the rise of “zero‑click” searches. SparkToro’s 2024 analysis of 332 million Google searches using Datos clickstream data found that only 360 out of every 1,000 US Google searches, and 374 out of every 1,000 EU searches, result in a click to a non‑Google website.

In that dataset, roughly 58.5% of US and 59.7% of EU searches ended with no click on any result—either because the query was answered directly in the SERP, the user refined their query, or they abandoned the search.

Industry CTR studies from Advanced Web Ranking still show that the first organic result attracts by far the highest share of clicks, but that click‑through rates at the top of the SERP have declined slightly over time for informational queries as Google surfaces more rich results and AI‑driven features.

For Australian businesses, this means that ranking well remains critical, but the type of query targeted and the SERP layout materially affect how much traffic those rankings will actually deliver.

Key Takeaway: Mobile dominance continues to grow, but desktop remains crucial for B2B sectors.

Voice Search Revolution

Current Usage Statistics

An Australian local SEO analysis finds that roughly one‑third of Australians use voice search on a daily basis, most often to find local businesses and services nearby; typical voice queries span 6–10 words.

Google has reported that around 76% of people who perform a local “near me” search on their smartphone visit a related business within a day, and about 28% of those searches lead to a purchase, underscoring how commercially important these conversational, localised queries are.

Voice search represents a shift in query shape more than an entirely new channel. A significant share of Australian users are comfortable asking their phones natural‑language questions, especially about nearby businesses.

When those “near me” voice queries translate into in‑person visits and purchases at the rates Google has reported—over three‑quarters of searchers visiting a business within a day—optimising for conversational, question‑based queries and local intent becomes a direct revenue driver rather than an experiment.

Australian businesses optimising for conversational queries report 27% higher lead generation compared to traditional keyword targeting.

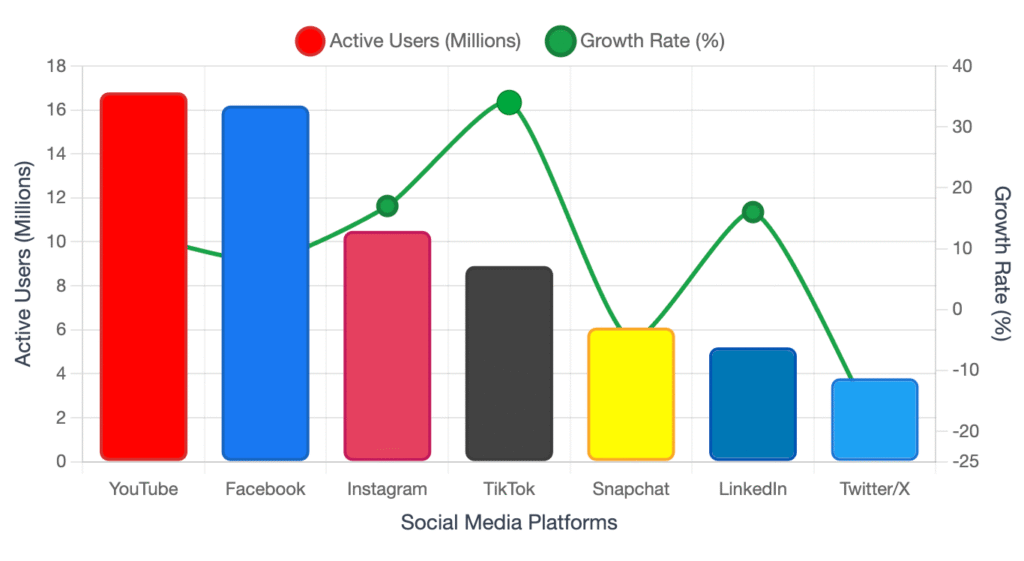

Social Media Landscape Update

The Australian social media ecosystem is experiencing unprecedented fragmentation, with traditional platforms facing aggressive competition from emerging players. This diversification demands sophisticated multi-platform strategies rather than single-channel focus.

Smart businesses are building platform-agnostic content systems that can adapt to rapidly changing user preferences and algorithm updates.

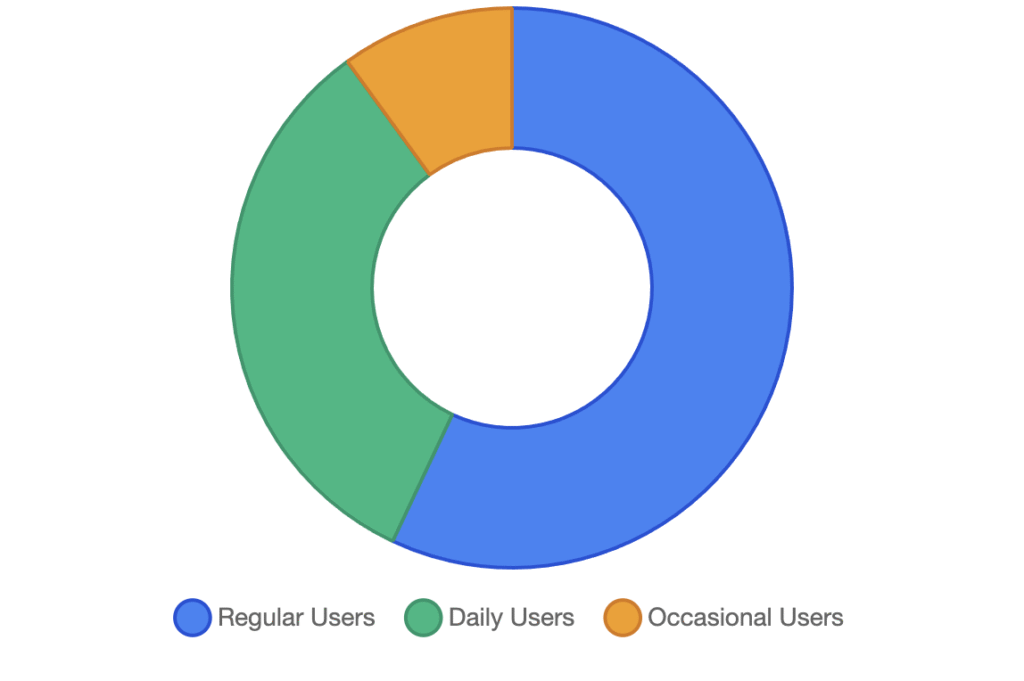

Monthly Active Australian Users

According to DataReportal’s Digital 2024: Australia report, there were 20.80 million social media user identities in Australia in January 2024, equivalent to 78.3% of the total population.

Meta’s ad‑planning tools show a Facebook advertising reach of around 16.65 million users in Australia in early 2024.

TikTok’s adult (18+) advertising audience in Australia is roughly 9.7 million users, reflecting rapid growth in recent years.

Time‑use data from We Are Social and Meltwater’s Digital 2024 Australia highlights that TikTok users spend over 42 hours per month on the app on Android, while YouTube users spend over 21 hours, placing both platforms at the top of the attention ladder (Source).

Marketer Platform Usage

Global surveys of marketers from Content Marketing Institute and MarketingProfs indicate that social media and short‑form video remain among the top distribution channels and investment priorities, with 69% of B2B marketers planning to increase spending on video and 45% expecting their overall content marketing budgets to rise in 2024.

Key Takeaway: Despite new platform emergence, Facebook maintains its position as Australia’s most influential social network.

Content Marketing Performance Metrics

Content marketing has evolved from nice-to-have to business-critical, with Australian companies now treating content as strategic infrastructure rather than marketing afterthought.

The most successful businesses have moved beyond creating content for content’s sake to developing systematic approaches that deliver measurable business outcomes. This maturation is driving significant ROI improvements across all content formats.

Performance Statistics

Multiple studies based on DMA data put the average ROI of email marketing at roughly $36–$38 for every $1 spent (3,500–3,800%), with best‑in‑class programs and sectors such as retail and ecommerce achieving $40–$45 per $1. These figures consistently position email as one of the highest‑ROI channels in the digital mix.

- Around 91% of businesses globally use video as a marketing tool, and 88–90% of video marketers say video delivers a positive ROI and has increased traffic or sales. (Source)

- Content Marketing Institute reports that 69% of B2B marketers plan to increase video spending in 2024, making it the top growth area for content investment. (Source)

- HubSpot’s 2024 AI trends for marketers report finds that 74% of marketers now use at least one AI tool at work, most commonly for research, drafting content, and writing copy, and a large majority report productivity and quality benefits.

Studies of interactive content—quizzes, calculators, assessments and tools—find that it typically generates around twice the conversions of static content, along with substantially higher engagement and lead quality.

For Australian brands competing in saturated niches, building interactive assets around high‑intent queries can be one of the fastest ways to lift conversion performance from existing traffic.

Long‑form content still has structural advantages in organic search. A BuzzSumo/Backlinko study of 912 million blog posts found that articles longer than 3,000 words attract 77.2% more referring domain links than posts under 1,000 words, which in turn supports stronger rankings for competitive queries.

Strategy Implementation

- 74% have documented content strategies (stable from 2024)

- 48% employ dedicated content strategists (up from 42%)

- 67% rate video as most effective content (up from 62%)

- Companies with documented strategies see 3.2x higher ROI

- Video content increases organic traffic by 157%

- Sustainability-focused content sees 22% higher engagement

The shift toward comprehensive content strategies marks a maturation in the Australian digital marketing space. Businesses are moving beyond random content creation to structured, data-driven approaches.

Local SEO Dominance

Local SEO has become the great equaliser in Australian digital marketing, allowing smaller businesses to compete effectively with national chains by dominating geographic markets.

The proximity between search intent and purchase action in local queries creates conversion opportunities that dwarf traditional digital marketing channels. Businesses that master local SEO fundamentals often see immediate, measurable impact on foot traffic and revenue.

Google’s own guidance and multiple industry analyses show that complete, well‑maintained Google Business Profiles earn far more visibility and interactions than incomplete listings—often several times more clicks and calls—because they are more likely to appear in local packs and on Google Maps.

At the same time, BrightLocal’s long‑running Local Consumer Review Survey consistently finds that the vast majority of consumers read online reviews when choosing a local business and expect recent, responded‑to reviews as a sign of trustworthiness.

Search Behavior and intent

- Google has indicated that roughly 46% of all Google searches carry local intent. (Source)

- Google’s local search research has also found that around 76% of people who perform a “near me” search on their smartphone visit a related business within 24 hours, and about 28% of those searches lead to a purchase. (Source)

Investment and Spending Patterns

- Australian SEO cost benchmarks place typical small‑business SEO retainers in the AUD $1,250–$3,000 per month range, with more competitive or multi‑location campaigns requiring higher budgets.

- Medium and large businesses often invest from $3,000 to $10,000+ per month in ongoing SEO, especially in competitive national verticals. (Source)

- IAB Australia’s Internet Advertising Revenue Report shows that search and directories attracted around $7.2 billion of ad spend in 2024, roughly 44% of total online advertising, and grew 10.1% year‑on‑year—underlining the central role of search in Australia’s digital media mix.

Key Takeaway: Local SEO services provides some of the highest ROI opportunities for Australian businesses.

Industry Challenges and Growth Opportunities

- ROI measurement difficulty: 47%

- Algorithm tracking: 42%

- Competition increase: 38%

Opportunities:

- Sustainability content: 22% higher engagement

- Long-tail keywords: 70% of searches

- AI-driven tools: 56% adoption potential

The Australian digital marketing landscape presents a classic innovator’s dilemma: established practices that worked historically are becoming less effective, while emerging opportunities require significant learning investments.

Businesses that navigate this transition successfully will establish competitive advantages that persist for years. Those that cling to outdated approaches face gradual obsolescence.

Primary Challenges Facing Australian Businesses

Measurement and complexity are now the dominant challenges for Australian marketers rather than simple channel adoption. Nielsen’s 2023 Annual Marketing Report finds that although a majority of marketers feel reasonably confident measuring ROI within individual channels, only just over half are confident measuring full‑funnel ROI across the customer journey.

Complementary research from the Content Marketing Institute shows that 84% of B2B marketers cite integrating or correlating data across multiple platforms as their biggest measurement challenge, followed by extracting insights from data (77%) and tying performance data to business goals (76%). (Source)

At the same time, Salesforce’s 9th State of Marketing report shows that 75% of marketers globally are experimenting with or have fully implemented AI in their operations, but also rank AI adoption as both their number‑one priority and their number‑one challenge, due to data, trust and skills gaps. For Australian teams, these global patterns play out against the backdrop of frequent Google core and local algorithm updates and rising zero‑click search behaviour.

Emerging High-Growth Opportunities

- Sustainability content: 22% higher engagement rates

- Long-tail keyword optimisation: 70% of all searches

- AI-driven content optimisation: 56% adoption rate among leaders

- Voice search optimisation: 27% lead generation increase

- Hyper-local SEO strategies: 32% conversion rate improvement

- Video content integration: 157% traffic increase potential

AI and Technology Integration

Artificial intelligence is transitioning from experimental technology to essential infrastructure in Australian digital marketing. Early adopters are already seeing significant competitive advantages, while businesses hesitant to embrace AI tools face growing disadvantages. This technological shift requires immediate attention—the window for comfortable adoption is rapidly closing.

Current Adoption Rates

- AWS’s Unlocking Australia’s AI Potential report estimates that 1.3 million Australian businesses—around 50%—are now regularly using AI, with adoption growing 16% year‑on‑year.

- Among AI adopters in Australia, 95% report an average revenue increase of 34%, 86% report productivity gains, and 94% expect average cost reductions of around 38%.

- HubSpot’s 2024 AI trends report finds that 74% of marketers globally are already using at least one AI tool for work, most commonly for research, writing and content creation.

- Salesforce’s 9th State of Marketing report shows that 75% of marketers are experimenting with or have fully implemented AI, and 63% of AI‑using marketers are using generative AI for content and journey orchestration.

Performance Impact

Businesses leveraging AI-powered SEO tools report:

- 23% improvement in keyword ranking velocity

- 31% reduction in content production time

- 18% increase in organic click-through rates

- 27% better local search visibility

Strategic Recommendations and Market Outlook

The Australian digital marketing landscape demands immediate strategic recalibration. Businesses that treat 2025 as a transition year—implementing AI tools, optimising for voice search, and building comprehensive local SEO strategies—will establish market positions that become increasingly difficult for competitors to challenge.

The $1.5 billion market will reward sophisticated execution over generic tactics.

Critical Success Factors for 2026:

- Voice search optimisation is forcing fundamental content strategy shifts

- Local SEO mastery creates immediate competitive advantages

- AI integration separates leaders from followers

- Mobile-first experience quality determines market success

- Sustainability messaging resonates powerfully with Australian consumers

Strategic Implementation Framework:

Immediate Actions (0-3 months):

- Audit and optimise Google Business Profile completeness or use the services of a Google Business Profile expert

- Implement conversational keyword targeting

- Deploy AI-assisted content workflows

- Prioritise mobile page speed optimisation

Medium-term Investments (3-12 months):

- Build comprehensive local SEO strategies

- Develop systematic video content production

- Implement advanced analytics and attribution

- Create sustainability-focused brand messaging

Long-term Planning (12+ months):

- Prepare for continued AI search evolution

- Build domain authority through E-E-A-T optimisation

- Develop omnichannel content distribution

- Invest in technical SEO infrastructure

Conclusion

The Australian SEO and digital marketing industry has reached an inflection point where technical sophistication meets strategic necessity. Success requires more than understanding individual tactics—it demands integrated thinking that connects user behaviour, technology evolution, and business objectives.

The $1.5 billion market valuation reflects genuine value creation, not speculative investment. Businesses that excel in this environment combine data-driven decision making with authentic user value creation, sophisticated technical execution with clear strategic vision.

Market outlook: Red Search projects that Australian SEO spending will reach around AUD 1.5 billion in 2025, up 12% on the previous year, and broader IAB Australia data shows search and directories ad spend growing around 10% year‑on‑year to $7.2 billion in 2024.

Taken together, these figures suggest that investment in search visibility—both paid and organic—will continue to grow steadily over the mid‑2020s, with AI‑assisted optimisation, local search, and video content likely to capture a disproportionate share of that growth.

Sources:

This analysis incorporates the latest industry data from authoritative sources including StatCounter Global Stats, DataReportal Digital 2025 Australia, Google Search Engine Market Share Analysis, BrightLocal Consumer Surveys, Content Marketing Institute Research, IAB Australia Digital Advertising Revenue Reports, and leading Australian digital marketing agencies.

Last updated: February 2026

- https://gs.statcounter.com/search-engine-market-share/all/australia

- https://www.brightlocal.com/research/local-consumer-review-survey/

- https://www.hootsuite.com/resources/digital-trends

- https://contentmarketinginstitute.com/wp-content/uploads/2024/10/b2b-2025-research.pdf

- https://www.hubspot.com/state-of-marketing

- https://www.wyzowl.com/video-marketing-statistics/

- https://ahrefs.com/blog/seo-statistics/

- https://backlinko.com/seo-stats

- https://www2.deloitte.com/au/en/pages/technology-media-and-telecommunications/articles/digital-marketing-trends.html

- https://www.gartner.com/en/marketing/research/annual-cmo-spend-survey-research