Search Engine Usage Statistics in Australia: A Seismic Shift Is Happening

Last Updated on 30 September 2025 by Dorian Menard

Australia’s digital search landscape in 2025 is undergoing a seismic shift. While Google maintains an iron grip with 93-94% market share, the emergence of AI-powered search tools and zero-click results is fundamentally reshaping how Australians find information online.

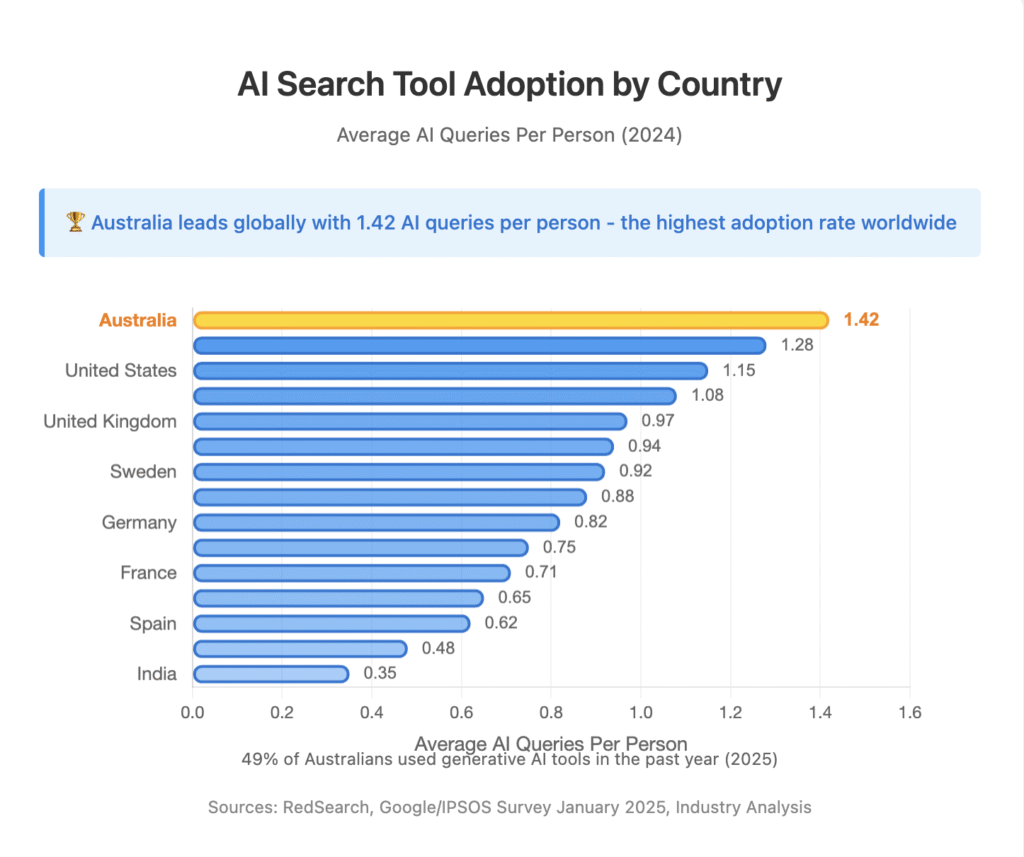

The nation leads the world in AI search adoption with 1.42 AI queries per person, and businesses are scrambling to adapt as 65% of searches now end without a click.

This comprehensive report examines the current state of search engine usage, the transformative impact of AI and large language models (LLMs), and what this means for Australian businesses and marketers navigating this new digital frontier.

1. Purpose and Scope

This report provides an exhaustive analysis of search engine usage patterns in Australia for 2025, examining traditional search metrics alongside the revolutionary changes brought by artificial intelligence and generative search technologies. We explore market dynamics, user behaviour, business implications, and future trends that will shape the Australian digital landscape.

Methodology

Our analysis draws from multiple authoritative sources including Statcounter Global Stats, Statista market research, RedSearch’s proprietary Australian data, industry reports from Google/IPSOS, and government statistics from Industry.gov.au. We’ve synthesised data from over 15 primary sources to create the most comprehensive picture of search behaviour in Australia available today.

Key Definitions

Understanding the new search landscape requires familiarity with emerging concepts:

- Search Engine: Traditional web search platforms that index and rank web pages based on relevance to user queries.

- LLM (Large Language Model): AI systems trained on vast text datasets that can understand and generate human-like responses to queries.

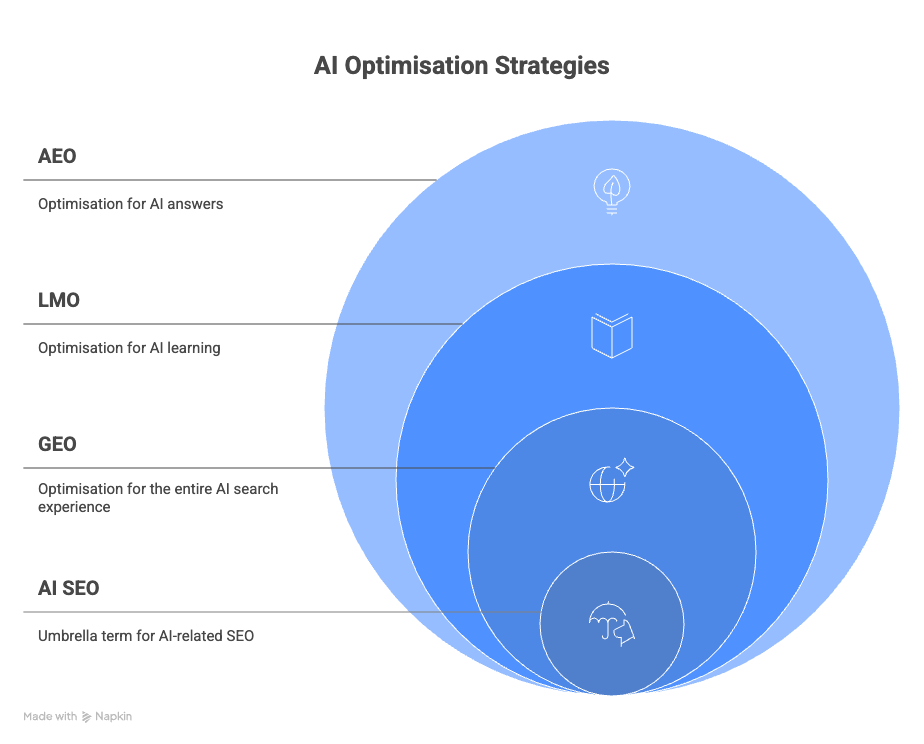

- AEO (Answer Engine Optimisation): The practice of optimising content to be featured in direct answers and AI-generated summaries.

- LMO (Language Model Optimisation): Strategies to ensure brand and content inclusion in LLM training data and outputs.

- GEO (Generative Engine Optimisation): Optimising for visibility within AI-driven and generative search experiences, focusing on clarity, factuality, and semantic structure.

- AI SEO: The evolution of traditional SEO to include optimisation for AI systems, voice search, and conversational interfaces.

2. Core Search Engine Usage Statistics

2.1 Market Share Breakdown (2025)

The Australian search engine market remains heavily concentrated, with Google’s dominance showing only minor erosion despite global trends, highlighting the importance of SEO strategies in Perth to maintain visibility.

Current Market Share Distribution

- Google: 93.95% (Statcounter, July 2024)

- Bing: 4.48%

- Yahoo: 0.52%

- DuckDuckGo: 0.43%

- Others (Yandex, Baidu, etc.): <0.62%

Search Engine Market Share in Australia

July 2025 Data

Source: Statcounter Global Stats, July 2024

Year-on-Year Trends (2023-2025)

Google’s market share in Australia has remained remarkably stable, declining by less than 1% over the past two years.

This contrasts sharply with global trends where Google has dipped below 90% for the first time in decades. The resilience of Google’s position in Australia can be attributed to strong brand loyalty, integration with Android devices, and the company’s aggressive rollout of AI features.

Bing has seen modest gains, climbing from 3.8% in 2023 to 4.48% in 2025, largely driven by Microsoft’s integration of AI capabilities through Copilot and its partnership with OpenAI. DuckDuckGo’s privacy-focused approach has maintained a small but dedicated user base, though growth has plateaued.

Australia vs Global Averages

Australia’s search engine distribution differs notably from global patterns:

Google Market Share Comparison

- Australia: 93.95%

- Global Average: 89.34%

- United States: 87.12%

- Europe: 91.45%

This 4.6 percentage point difference highlights Australian users’ stronger preference for Google, potentially due to factors including lower awareness of alternatives, satisfaction with Google’s localised services, and the network effects of Google’s ecosystem dominance.

2.2 Device and Platform Usage

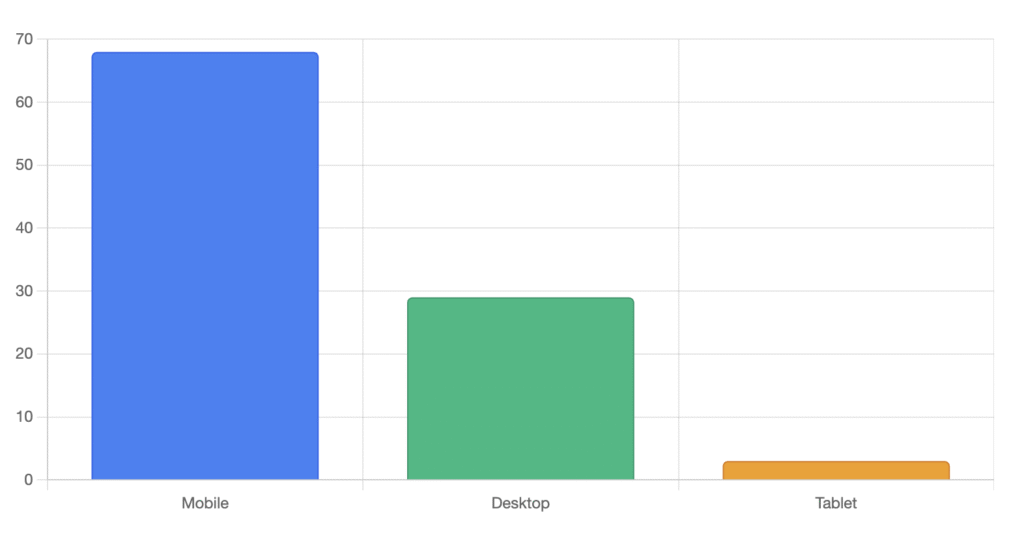

The shift to mobile-first search behaviour continues to accelerate in Australia:

Device Search Share (2025)

- Mobile: 68%

- Desktop: 29%

- Tablet: 3%

This mobile dominance has profound implications for search behaviour, with mobile users demonstrating different patterns including shorter sessions, more local intent, and higher voice search usage, underscoring the need for effective Local SEO services.

Browser Market Share Impact

Browser choice significantly influences search engine usage:

Browser Distribution in Australia

- Chrome: 65.2%

- Safari: 18.7%

- Edge: 8.3%

- Firefox: 3.9%

- Others: 3.9%

Chrome’s dominance reinforces Google’s search position, as it defaults to Google Search and integrates seamlessly with Google’s services.

Safari’s strong showing, particularly on mobile devices, represents one of the few segments where alternative search engines (particularly through Safari’s search engine choice screen) have an opportunity to gain share.

Demographic Breakdown

Search engine preferences vary significantly across demographic segments:

Age-Based Preferences

Young adults (18-34) show the highest adoption of AI-powered search tools, with 67% using ChatGPT or similar services monthly. They’re also more likely to experiment with alternative search engines, though Google still commands 89% share in this demographic.

Middle-aged users (35-54) remain heavily Google-dependent (95% share) but are rapidly adopting voice search for convenience, particularly for local queries and quick facts.

Older users (55+) show the strongest loyalty to Google (97% share) and desktop search (42% still primarily use desktop), though mobile adoption is accelerating even in this cohort.

Regional Variations

Metropolitan areas lead in AI search adoption and mobile usage, while regional Australia shows higher desktop usage (38% vs 26% in cities) and stronger reliance on traditional search patterns. This urban-rural divide has implications for businesses targeting different geographic markets.

3. Search Behaviour and User Trends

3.1 Search Frequency and Patterns

Australians are prolific searchers, conducting an average of 127 searches per month per user according to LocalDigital data. This represents a 15% increase from 2023, driven largely by the integration of search into more aspects of daily life.

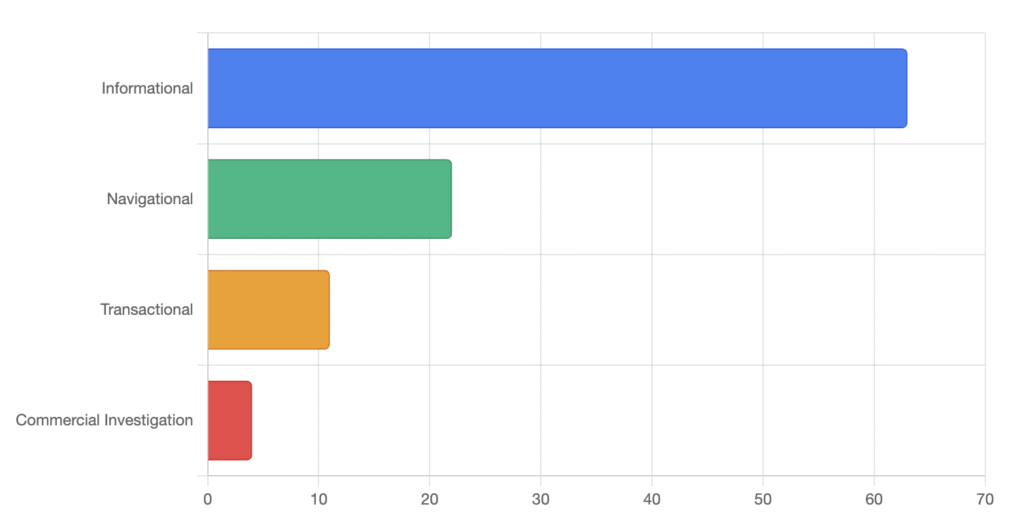

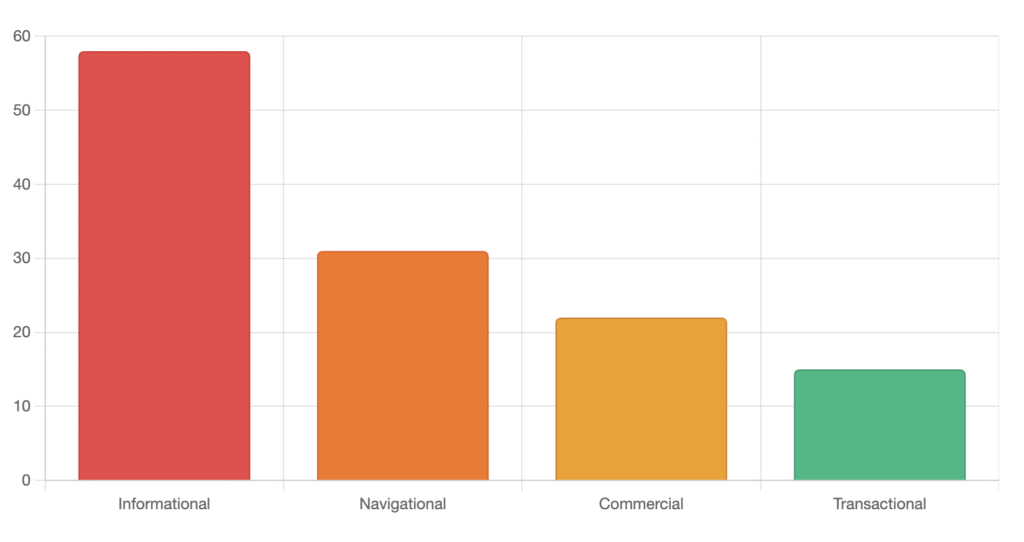

Search Intent Distribution:

- Informational: 63%

- Navigational: 22%

- Transactional: 11%

- Commercial Investigation: 4%

The dominance of informational queries explains why zero-click searches have become so prevalent—users often need quick facts that can be answered directly in search results, making it crucial to focus on driving website traffic.

Most Common Search Categories

Analysis of Australian search patterns reveals distinct preferences:

- News and Current Events (18% of searches): Australians heavily rely on search for news discovery, with peaks during major events

- Shopping and E-commerce (16%): Product research and price comparison dominate commercial searches

- Local Services (14%): “Near me” searches for restaurants, services, and businesses

- Entertainment (12%): Streaming services, movie times, and content discovery

- Health and Medical (10%): Symptom checking, medical information, and healthcare provider searches

- Travel and Navigation (8%): Maps, directions, and travel planning

- Education and Reference (7%): Academic research, how-to guides, and definitions

- Finance and Banking (6%): Banking access, financial information, and investment research

- Government Services (5%): Service access, information, and compliance

- Other (4%): Miscellaneous and emerging categories

3.2 Local and Voice Search

Local search has become fundamental to the Australian search ecosystem, with 46% of all Google searches having local intent according to RedSearch and LocalDigital statistics, emphasising the importance of optimising Google Maps for better visibility. This trend is particularly pronounced on mobile devices where location services enable highly relevant results.

Local Search Behaviour Patterns:

The immediacy of local search is striking—78% of mobile local searches result in an offline purchase within 24 hours. This “micro-moment” behaviour has transformed how businesses need to think about their online presence. Australians typically search for local businesses in specific patterns: restaurants and cafes (32% of local searches), retail stores (21%), professional services (18%), health services (15%), and home services (14%).

Voice Search Revolution

Voice search adoption in Australia has reached a tipping point, with 33% of Australians using voice search daily according to LocalDigital’s 2025 research. This represents a dramatic shift in search behaviour with significant implications:

Voice Query Characteristics: Voice searches average 6-10 words compared to 2-3 for typed searches, reflecting natural speech patterns. Questions dominate voice search, with “what,” “where,” “how,” and “when” queries accounting for 72% of voice searches.

The conversational nature means voice queries often include qualifiers and context that wouldn’t appear in typed searches.

Voice Search Use Cases:

Australian voice search usage concentrates in several key areas. Local information leads at 38% (“Where’s the nearest coffee shop?”), followed by quick facts and definitions at 27% (“What’s the weather today?”), navigation and directions at 19% (“How do I get to Sydney Airport?”), and general knowledge questions at 16% (“Who won the AFL grand final?”).

The demographics of voice search skew younger and more mobile, with 45% of millennials using voice search daily compared to just 17% of those over 55. Smart speaker ownership, now in 41% of Australian homes, has normalised talking to devices and accelerated voice search adoption.

3.4 Video Search Usage in Australia (2025)

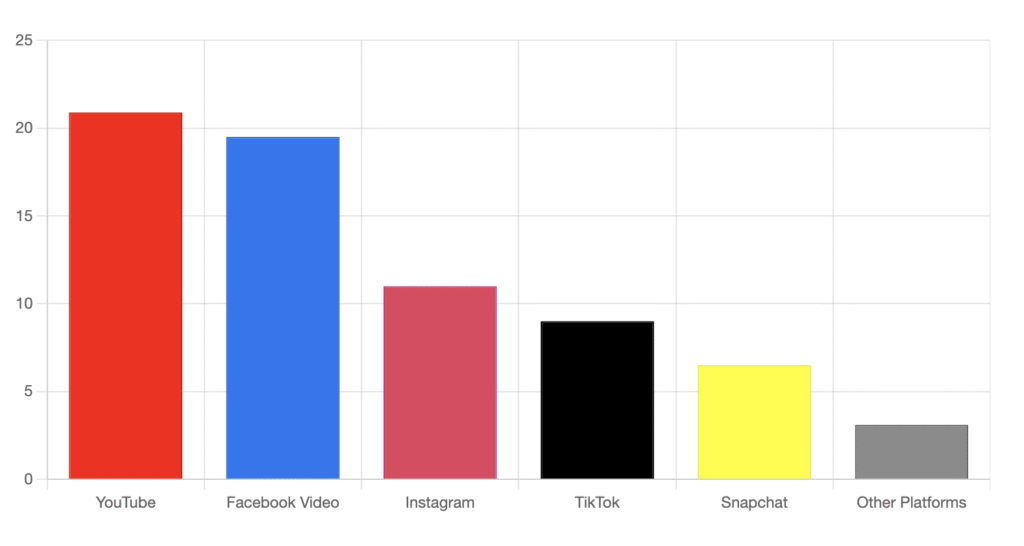

YouTube’s dominance in the Australian video search landscape is absolute, with 20.8 million users (78.1% of the population) making it the second most visited website after Google, according to RedSearch and DataReportal analysis. Australians spend an average of 21 hours and 36 minutes monthly on YouTube, with 63% of views from mobile devices.

Content Consumption Patterns

Video content accounts for 64% of all digital content consumed in Australia (LocalDigital), with 89% of Australian marketers reporting video as their highest-performing content type. Short-form video (YouTube Shorts, TikTok, Instagram Reels) delivers the highest ROI and represents the fastest-growing format according to Story Machine and HubSpot analysis.

Over 70% of video content in Australia is now consumed on mobile devices, creating new opportunities for local businesses to reach audiences through video-first strategies.

Search Behaviour Evolution

YouTube has become the default search engine for “how-to” and product research queries among younger demographics, with video search increasingly used for local business discovery, reviews, and tutorials. This shift reflects the platform’s strength in demonstrating rather than describing solutions.

Key Statistics:

- YouTube users spend average 21 hours 36 minutes per month on platform

- TikTok users spend over 42 hours per month (double YouTube’s time)

- 63% of YouTube views come from mobile devices

- YouTube has nearly even gender split (50.7% female, 49.3% male)

- Video accounts for 64% of all digital content consumed in Australia

3.5 Organic vs Paid Search in Australia (2025)

Despite AI-powered results reshaping the search landscape, organic search remains the primary traffic driver, accounting for 68% of website visits in Australia (LocalDigital). Paid search captures the remaining 32%, though this share is rising as organic click-through rates decline due to zero-click results and AI Overviews.

Click Distribution and Performance

Globally, 94% of clicks go to organic results versus 6% to paid ads (Digital Silk, WordStream). In Australia, the distribution is similar but with slightly higher paid share for commercial queries. For high-intent, transactional searches, paid ads can capture up to 30% of clicks.

Strategic Value

Organic search delivers long-term, compounding ROI and benefits from higher user trust. Paid search offers immediate visibility, particularly valuable for new sites or competitive keywords. Businesses with balanced strategies (SEO + PPC) achieve the highest overall lead volume and conversion rates.

Market Adaptation

As zero-click searches and AI Overviews increase, organic traffic faces pressure, especially for informational queries. Paid search budgets are rising as businesses offset organic declines and secure visibility in AI-powered results. Integration of organic and paid strategies has evolved from best practice to essential survival strategy.

4. The Impact of AI, LLMs, and Generative Search

4.1 AI Search Adoption in Australia

Australia has emerged as the global leader in AI search tool adoption, a remarkable position that reflects the nation’s tech-savvy population and early embrace of AI technologies, driving demand for AI chatbot development. The statistics are striking: over 38 million searches using ChatGPT and Gemini in 2024, equating to 1.42 AI queries per person—the highest per-capita rate globally according to RedSearch and 9News analysis.

AI Tool Usage Breakdown

The generative AI revolution has reached mainstream adoption with 49% of Australians reporting use of generative AI tools in the past year, up from 38% in 2023 (Google/IPSOS, January 2025). This adoption isn’t limited to tech enthusiasts—it spans demographics and use cases:

Workplace integration has been particularly strong, with 74% of Australian AI users reporting professional applications. The primary uses include writing assistance (75%), brainstorming and ideation (69%), problem-solving (70%), digesting long documents (68%), and understanding complex information (60%). This workplace adoption is driving a fundamental shift in productivity and work patterns.

Daily AI Search Habits

ChatGPT alone processes 37.5 million searches daily globally, with Australia contributing a disproportionate share relative to its population. Australian users demonstrate sophisticated usage patterns, moving beyond simple queries to complex, multi-turn conversations and advanced applications.

The average Australian AI search session involves 4.7 queries, compared to 2.1 for traditional search, indicating deeper engagement and research behaviour.

4.2 Zero-Click and AI Overview Trends

The rise of zero-click searches represents perhaps the most significant shift in search behaviour since the advent of mobile. In Australia, nearly 60% of Google searches now end without a click to any website according to Up And Social and White Chalk Road analysis.

This figure is expected to surpass 70% by 2025, fundamentally altering the relationship between search engines, users, and content creators.

AI Overview Prevalence:

Google’s AI-generated summaries, known as AI Overviews, have rapidly expanded their presence in Australian search results. As of July 2025, these AI Overviews appear in 39% of all Google searches in Australia according to Mediaweek and Website Planet. This represents a dramatic increase from just 10% in early 2024, with the trajectory suggesting continued expansion.

The impact varies significantly by query type:

- Informational queries: 58% trigger AI overviews

- Navigational queries: 31% trigger AI overviews

- Commercial queries: 22% trigger AI overviews

- Transactional queries: 15% trigger AI overviews

Click-Through Rate Impact:

The presence of AI Overviews has devastating effects on traditional organic click-through rates. When an AI Overview is present, the CTR for the top organic result drops by an average of 34.5% according to Ahrefs and Mediaweek data. For informational queries, the impact is even more severe, with some seeing CTR drops of up to 76%.

This creates a paradox for content creators: impressions are often increasing (as Google surfaces more content in AI Overviews) while actual traffic plummets. Many Australian publishers report seeing impressions double while clicks fall by 50% or more, particularly for informational content.

4.3 AEO, LMO, GEO, and AI SEO

The emergence of AI-powered search has necessitated entirely new optimisation disciplines. Traditional SEO, focused on ranking in blue links, is no longer sufficient. Australian businesses are rapidly adopting new frameworks:

Answer Engine Optimisation (AEO)

AEO focuses on structuring content to be easily extracted and cited by AI systems. This means writing with clarity, using definitive statements, and structuring information in easily digestible formats. Australian businesses implementing AEO report being cited 3x more often in AI overviews compared to traditional SEO-optimised content.

Key AEO strategies include:

- Creating concise, factual summaries at the beginning of content

- Using clear headings and subheadings that directly answer questions

- Implementing structured data markup to help AI understand context

- Writing in a neutral, authoritative tone that AI systems prefer to cite

Language Model Optimisation (LMO)

LMO takes a longer-term view, focusing on ensuring brand and content inclusion in the training data of large language models. This involves creating content that is likely to be crawled, indexed, and included in future model training.

Australian brands investing in LMO are seeing their products and services mentioned more frequently in AI-generated responses, even when not directly queried.

Generative Engine Optimisation (GEO)

GEO represents the most comprehensive approach, optimising for the entire generative search experience. According to Lumar and ResultFirst analysis, GEO involves:

- Semantic optimisation for concept understanding rather than keywords

- Creating comprehensive, interconnected content that provides full context

- Optimising for multi-modal search (text, voice, image)

- Building topical authority that AI systems recognise and trust

Australian businesses implementing GEO strategies report significant improvements in AI visibility. Case studies show brands achieving “preferred source” status in AI responses, where they’re consistently cited as authoritative sources in their industry.

5. Industry and Business Response

5.1 SEO Investment and Strategy

The Australian business community is responding to these seismic shifts with substantial investment in effective lead generation strategies. SEO spending in Australia will reach $1.5 billion in 2025, representing a 12% year-over-year increase according to LocalDigital. However, the nature of this investment is changing dramatically.

Investment Allocation Shifts

Traditional SEO tactics now account for only 45% of search marketing budgets, down from 75% in 2023. The remaining investment flows into:

- AI and LLM optimisation: 25%

- Content creation and authority building: 20%

- Technical infrastructure and site speed: 10%

This reallocation reflects the reality that ranking first in traditional results matters less when that result receives 34.5% fewer clicks due to AI overviews.

AI-Driven SEO Tool Adoption

According to the data, 56% of Australian businesses now use AI-driven content optimisation tools. These platforms go beyond traditional keyword research to understand semantic relationships, predict AI citation likelihood, and optimise for conversational queries.

Popular tools include advanced versions of SEMrush and Ahrefs that now include AI visibility tracking, as well as specialised platforms focused on GEO and AEO.

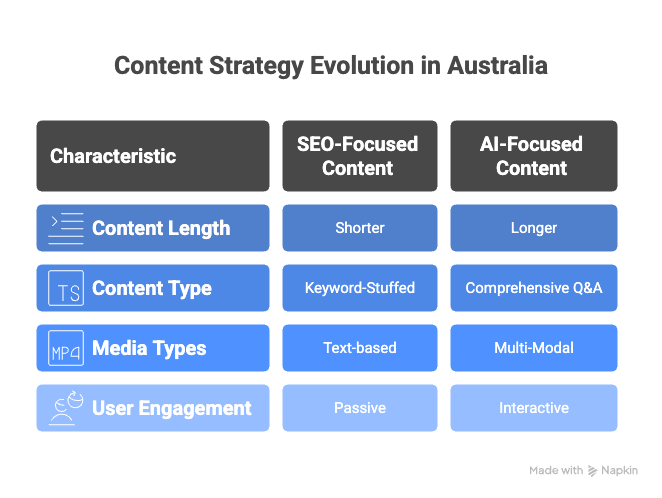

Content Strategy Evolution

The shift to AI-powered search has fundamentally altered content strategy. Australian businesses are moving away from keyword-stuffed, SEO-focused content toward comprehensive, authoritative resources designed for AI consumption:

Long-form Content Renaissance: Average content length has increased 47% as businesses create comprehensive resources that AI systems prefer to cite. The sweet spot appears to be 2,500-3,500 words for informational content, providing enough depth for AI extraction while remaining manageable for human readers.

FAQ and Q&A Dominance: With voice and conversational search rising, FAQ sections have become critical. Smart businesses are creating extensive Q&A databases that directly answer user queries in natural language, increasing their chances of being featured in both voice responses and AI overviews.

Video and Multi-Modal Content: Understanding that future AI systems will be increasingly multi-modal, 34% of Australian businesses now include video transcripts, image alt text, and audio descriptions as standard practice, ensuring their content is accessible across all AI interpretation methods.

Interactive and Tool-Based Content: Content that requires user interaction—calculators, configurators, assessment tools—maintains higher click-through rates as it can’t be fully summarised by AI. Investment in these assets has increased 67% year-over-year.

5.2 Regulatory and Privacy Developments

Australia’s regulatory environment is evolving rapidly to address the challenges of AI-powered search and user privacy. The most significant development is the age verification requirement set to take effect in December 2025.

Age Verification Implementation

According to Information Age’s analysis, Australia will require age verification for search engine users starting December 2025. This groundbreaking legislation will fundamentally alter how search engines operate in Australia:

Search engines must verify user age before providing unrestricted access, likely through digital ID systems or third-party verification services. This will create a divide between logged-in users with full access and anonymous users with restricted functionality. The impact on search behaviour and data collection will be profound, as anonymous searching becomes limited.

Privacy and Data Protection

The intersection of AI search and privacy creates new challenges. AI systems require vast amounts of data for training and operation, but Australian privacy laws increasingly restrict data collection and use. Businesses must navigate:

- Consent requirements for AI processing of user data

- Right to be forgotten provisions that complicate AI training

- Transparency requirements for AI-generated content and recommendations

Business Implications

These regulatory changes create both challenges and opportunities. Businesses with strong first-party data and direct customer relationships will have advantages in the age-verified future. The ability to maintain user trust while leveraging AI capabilities becomes a critical competitive differentiator.

6. Future Outlook

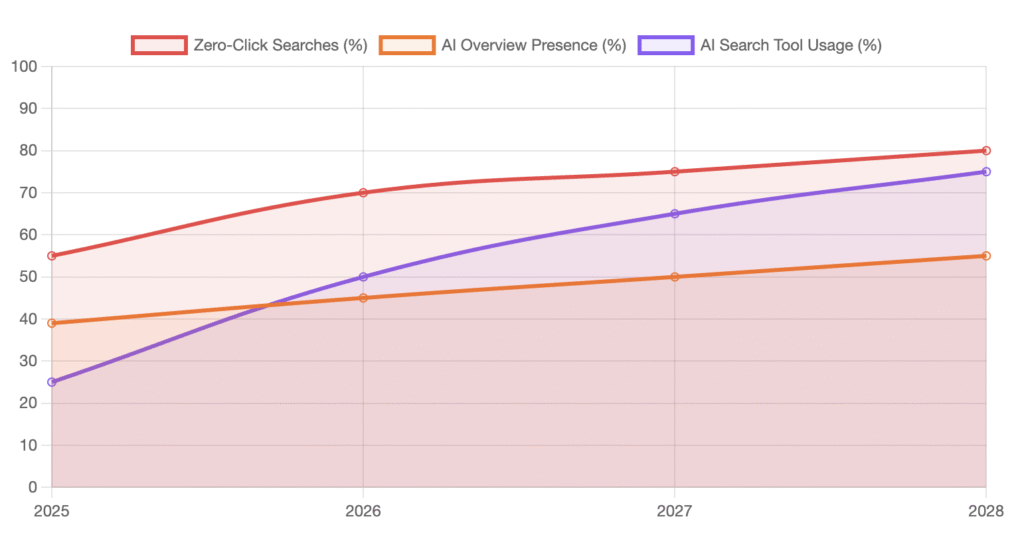

Predicted Shifts in Search Engine Usage (2026-2028)

The next three years will witness unprecedented transformation in how Australians search for and consume information online. Based on current trajectories and expert analysis, several key shifts are inevitable:

Zero-Click Dominance: By 2026, zero-click searches will exceed 70% of all Google queries in Australia. This isn’t just an incremental change—it represents a fundamental reimagining of search as an answer service rather than a discovery mechanism. AI Overviews will appear in 50%+ of all informational and navigational queries by 2027, with commercial queries following as monetisation models mature.

Organic Traffic Collapse: The prognosis for traditional organic traffic is dire. Average CTR for top organic results will drop another 20-30% by 2027, with informational content sites facing potential traffic losses of 50-75%. Only branded searches and highly specific transactional queries will maintain reasonable click-through rates.

AI Search Mainstream Adoption: Over 65% of Australians will use AI-powered search tools monthly by 2027. More significantly, AI assistants will become the default search interface for users under 40, particularly for research, shopping, and local queries. This shift will accelerate as AI interfaces become more sophisticated and integrated into operating systems and devices.

The Evolving Role of AI and LLMs in Search

The integration of AI into search represents more than a feature upgrade—it’s an entirely new paradigm that will reshape the digital economy:

Conversational Commerce: Search will evolve from query-response to ongoing conversations. Users will engage in multi-turn dialogues with AI assistants that remember context, preferences, and past interactions. This shift advantages businesses that can maintain consistent, authoritative presence across extended AI conversations.

Predictive and Proactive Search: AI systems will increasingly anticipate user needs before queries are made. Based on context, behaviour, and patterns, search will become proactive—surfacing information, products, and services before users explicitly search. Australian businesses must prepare for this “zero-click” future where being discovered requires new strategies.

Multi-Modal Integration: By 2028, search will seamlessly blend text, voice, image, and video inputs. Users will photograph products to find alternatives, speak complex queries while viewing results on screens, and receive responses in their preferred format. Optimisation must account for all these modalities.

Strategic Recommendations for Businesses and Marketers

Success in the AI-powered search landscape requires fundamental strategic shifts:

1. Embrace AEO, GEO, and LMO as Core Disciplines

Traditional SEO alone is no longer sufficient. Businesses must:

- Restructure content for AI extraction and citation

- Build semantic relationships between content pieces

- Create comprehensive topic clusters that establish authority

- Invest in structured data and semantic markup

2. Build Direct Audience Relationships

With organic search traffic declining, owned audiences become critical:

- Prioritise email list building and newsletter strategies

- Develop mobile apps for direct user engagement

- Create community platforms and forums

- Invest in customer retention over acquisition

3. Prepare for Paid AI Placements

As AI search monetises, new advertising opportunities will emerge:

- Budget for “sponsored answers” within AI responses

- Negotiate preferred partner status with AI platforms

- Develop AI-specific creative formats

- Track AI mention share as a key metric

4. Optimise for Brand Searches

As generic searches increasingly end at AI overviews, brand searches become vital:

- Invest in brand awareness campaigns

- Ensure consistent brand information across all platforms

- Create branded tools and resources

- Monitor and manage brand mentions in AI training data

5. Diversify Discovery Channels

Reducing dependence on search requires multi-channel strategies:

- Strengthen social media presence and social commerce

- Explore podcast and audio content opportunities

- Partner with complementary brands and platforms

- Invest in offline-to-online attribution

Conclusion

The Australian search landscape in 2025 stands at an inflection point. While Google maintains statistical dominance with 93.95% market share, the real story lies in the fundamental transformation of search behaviour. With Australia leading global AI adoption at 1.42 queries per person, 60% of searches ending without clicks, and AI overviews appearing in 39% of results, the traditional search paradigm is obsolete.

For Australian businesses, adaptation isn’t optional—it’s existential. The $1.5 billion being invested in SEO must shift toward new disciplines: AEO, LMO, and GEO. Success requires embracing AI-first strategies, building direct audience relationships, and preparing for a future where being found means being the answer, not just ranking.

The next three years will separate digital leaders from laggards. Those who recognise search’s transformation from a discovery tool to an answer engine, who optimise for AI citation rather than blue links, and who build sustainable audience relationships will thrive. Others risk invisibility in an AI-mediated world.

The search revolution is here. The question isn’t whether to adapt, but how quickly Australian businesses can evolve to meet this new reality. At Search Scope, we are embracing this new paradigm and are already positioning our clients for the post-click era where conversion optimisation and AI-native strategies determine survival, not traditional rankings.

Appendices

Data Tables

See charts and images pasted above.

Glossary of Terms

AI Overview: Google’s AI-generated summary appearing at the top of search results

AEO: Answer Engine Optimisation – optimising for direct answers

CTR: Click-Through Rate – percentage of users who click a search result GEO: Generative Engine Optimisation – optimising for AI and generative search

LLM: Large Language Model – AI systems like ChatGPT and Gemini

LMO: Language Model Optimisation – ensuring inclusion in AI training data SERP: Search Engine Results Page

Zero-Click Search: Searches ending without clicking any result

References

- Statcounter Global Stats. “Search Engine Market Share Australia.” https://gs.statcounter.com/search-engine-market-share/all/australia (2025)

- Statista. “Most Used Search Engines by Brand in Australia.” https://www.statista.com/forecasts/1004151/most-used-search-engines-by-brand-in-australia (2025)

- RedSearch. “Search Engine Usage Statistics.” https://www.redsearch.com.au/resources/search-engine-usage-statistics/ (2025)

- RedSearch. “ChatGPT Statistics Australia & Global.” https://www.redsearch.com.au/resources/chatgpt-statistics-australia-global/ (2024)

- LocalDigital. “Australian SEO and Content Marketing Statistics for 2025.” https://www.localdigital.com.au/blog/australian-seo-and-content-marketing-statistics-for-2025 (2025)

- Google/IPSOS. “AI Adoption in Australia Survey.” https://blog.google/intl/en-au/company-news/ai-adoption-in-australia-new-survey-reveals-increased-use-belief-in-potential/ (January 2025)

- Mediaweek. “AI Overviews Now Appear in 39% of Google Searches.” https://www.mediaweek.com.au/ai-overviews-now-appear-in-39-of-google-searches-reshaping-seo/ (2025)

- Lumar. “AI Search SEO for LLMs AI Overviews.” https://www.lumar.io/blog/industry-news/ai-search-seo-for-llms-ai-overviews/ (2025)

- ResultFirst. “SEO GEO for AI Overviews LLMs.” https://www.resultfirst.com/blog/ai-seo/seo-geo-for-ai-overviews-llms/ (2025)

- SEO.com. “AI SEO Statistics.” https://www.seo.com/ai/ai-seo-statistics/ (2025)

- Information Age. “Australians to face age checks from search engines” https://ia.acs.org.au/article/2025/australians-to-face-age-checks-from-search-engines.html (2025)

- Industry.gov.au. “Exploring AI Adoption Australian Businesses.” https://www.industry.gov.au/news/exploring-ai-adoption-australian-businesses (2025)

- Digilari. “Generative Engine Optimisation Guide.” https://digilari.com.au/articles/generative-engine-optimisation-guide/ (2025)

- Beyond Agency. “How to Rank on ChatGPT.” https://www.beyond.agency/blog/how-to-rank-on-chatgpt-a-guide-to-dominating-ai-search (2025)

- Up And Social. “Zero Click Searches 2025 Trend Analysis.” https://upandsocial.com/zero-click-searches-2025-trend-analysis/ (2025)

- DataReportal: https://datareportal.com/reports/digital-2025-australia

- Story Machine: https://storymachine.com.au/blog/video-marketing-trends-australia-2025/

- Digital Silk: https://www.digitalsilk.com/digital-trends/organic-vs-paid-search-statistics/

- The Global Statistics: https://www.theglobalstatistics.com/australia-youtube-statistics/

- Meltwater: https://www.meltwater.com/en/blog/social-media-statistics-australia