The Traffic Cliff: How Google’s AI Overviews Slashed Australian Publisher Revenue by 35%

Last Updated on 12 January 2026 by Dorian Menard

One year after Google unleashed AI Overviews on Australian publishers in October 2024, exclusive data reveals what many suspected but few wanted to admit: the search traffic cliff is real, it’s steep, and it’s accelerating.

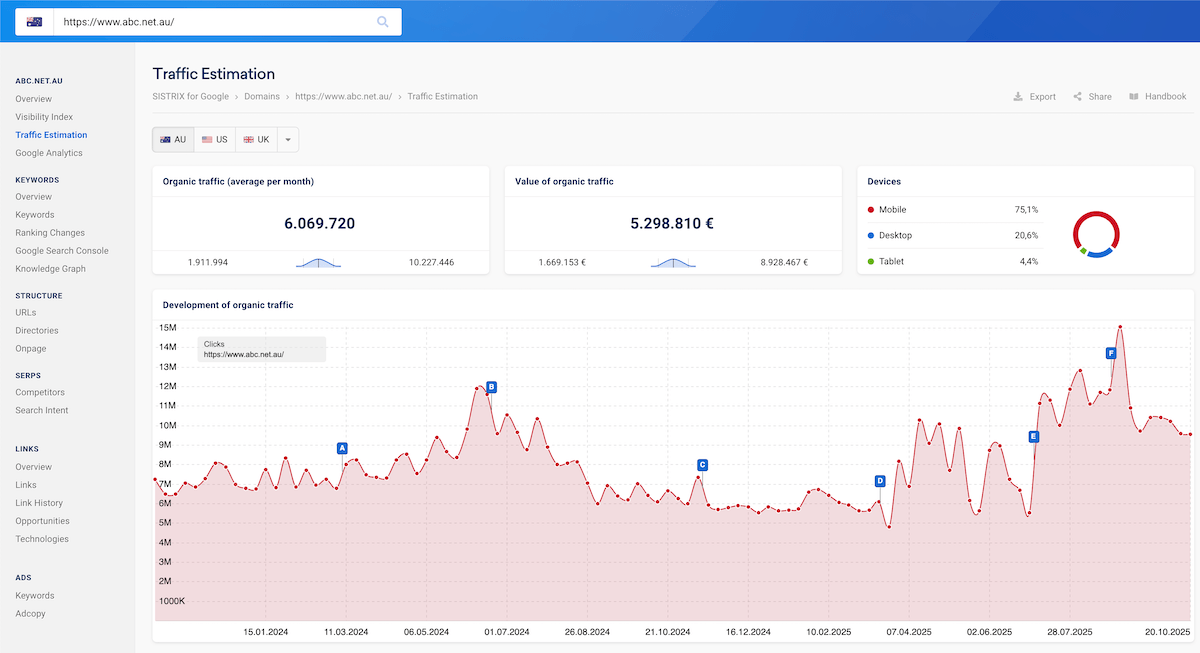

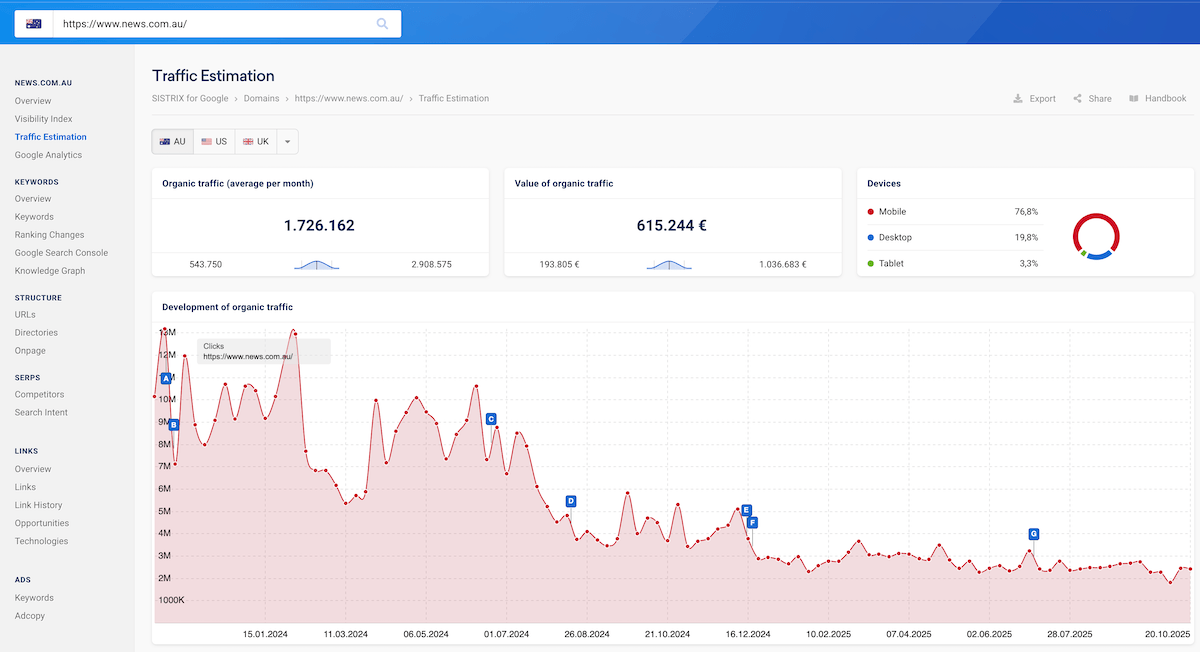

Daily Mail Australia watched 35% of its traffic vanish into thin air. Nine News lost 20%. News.com.au and the Sydney Morning Herald both bled 18%. Even stalwarts like ABC News and The Guardian couldn’t escape, shedding 9-13% of their audience.

The Numbers Don’t Lie

Daily Mail Australia’s traffic drop in just 12 months since AI Overviews launched. ABC, News.com.au, and SMH lost 9-20%. With AI Mode now live in Australia, the worst is yet to come.

But here’s where it gets worse. On October 8, 2025, Google launched AI Mode in Australia, a conversational search experience that ditches blue links entirely in favour of AI-generated answers. Early data from US markets suggests up to 90% of AI Mode sessions end without a single click-through, compared to around 40% for traditional search.

With Google commanding 94% of Australia’s search market, Western Australian news publishers face a brutal reality: adapt in the next 60-90 days or watch revenue collapse like their eastern counterparts. This isn’t speculation anymore. It’s happening right now.

The Data Carnage: Quantifying the Traffic Massacre

Let’s stop dancing around the numbers and lay them out cold. According to exclusive SimilarWeb data obtained by ABC News, Australia’s biggest news websites have suffered catastrophic traffic losses since AI Overviews rolled out in October 2024.

| Publisher | Traffic Decline (Oct 2024 – Oct 2025) |

|---|---|

| Daily Mail Australia | -35% |

| 9news.com.au | -20% |

| News.com.au | -18% |

| Sydney Morning Herald | -18% |

| The Guardian Australia | -13% |

| ABC News | -9% |

| SBS | -9% |

| 7news.com.au | -9% |

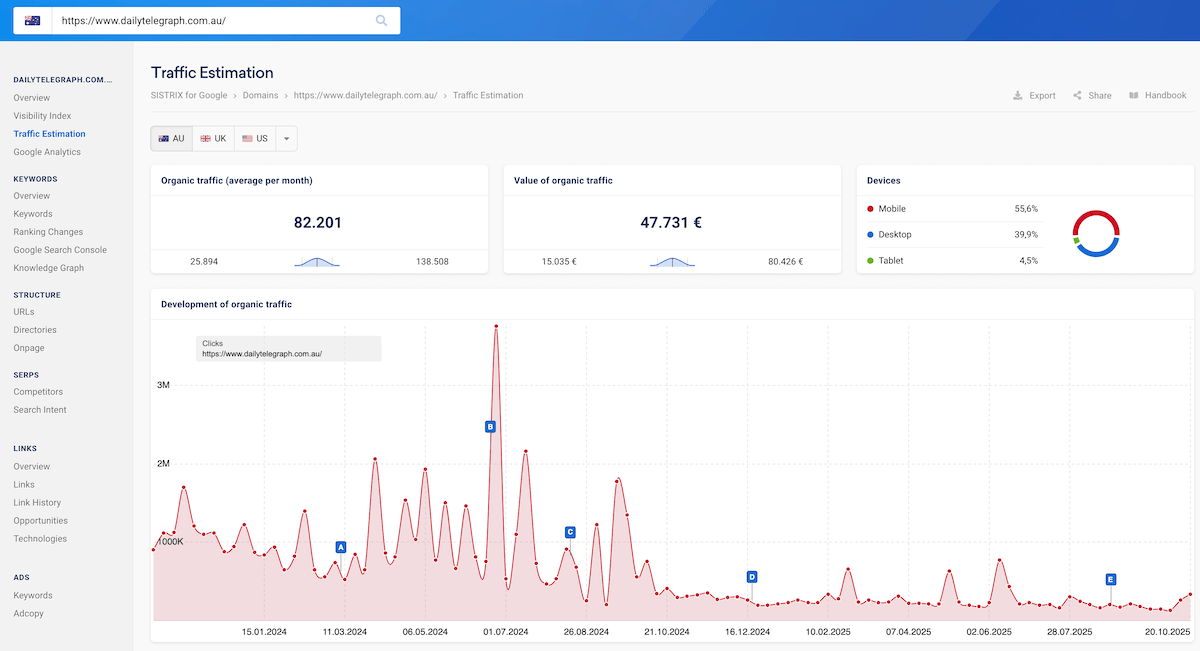

These aren’t small fluctuations. These are business-ending drops that force newsrooms to make impossible decisions about which journalists to keep and which beats to abandon.

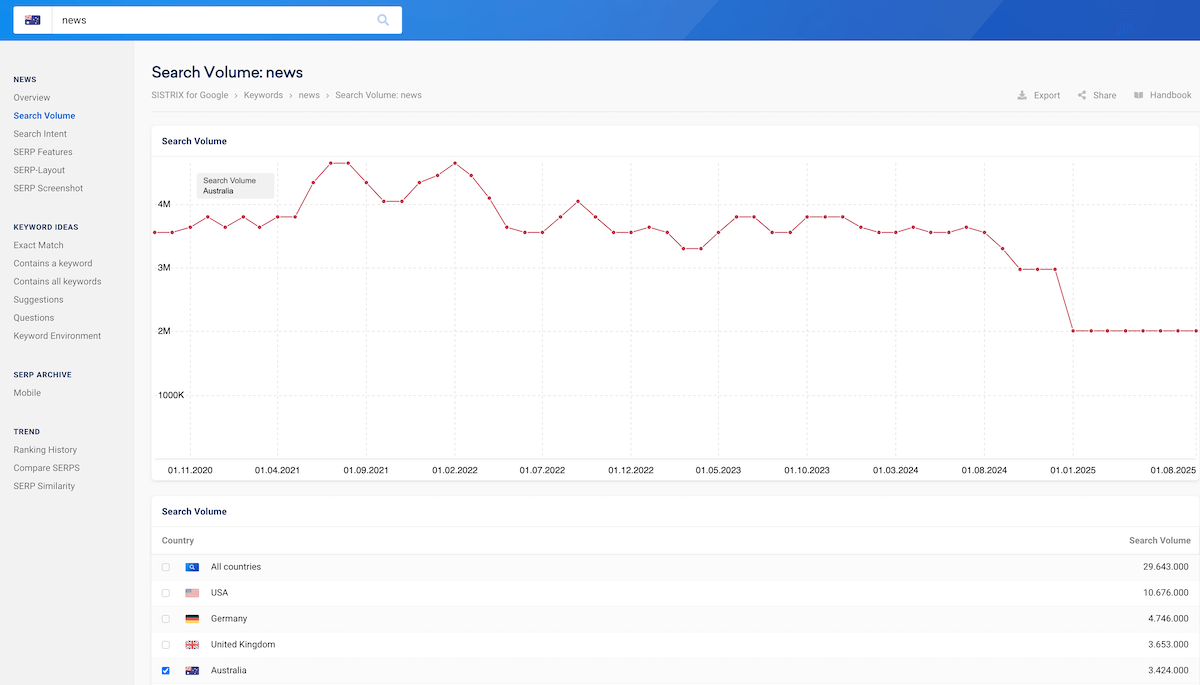

Search volume trend for “news” in Australia showing declining interest as AI summaries satisfy queries

Zero-Click Searches Are Eating Everything

The underlying driver of this traffic apocalypse? Zero-click searches, where users get their answer directly from Google without ever visiting a website. And it’s accelerating at a terrifying pace.

In 2022, 26% of searches ended without a click. By 2024, that jumped to 58%. Today in 2025, we’re sitting at 69% for news-related searches specifically. Industry analysts project 85% by 2027 if current trends continue. That’s not a future problem. That’s 18 months away.

ABC News traffic estimation showing the impact of AI Overviews on organic traffic

Google’s AI Overviews don’t trigger uniformly across all query types. The data reveals which content categories are most at risk.

Informational queries like “how to” guides and explainers trigger AI Overviews 77% of the time. These are the bread-and-butter evergreen articles that drove consistent traffic for years. Commercial queries hit 49%, while transactional queries are at 29%.

Translation: if your content strategy relies heavily on educational how-to content, you’re getting absolutely hammered right now.

Screen Real Estate Theft: Position 1 Doesn’t Matter Anymore

Remember when ranking first on Google meant something? Those days are gone.

Mobile: AI Overviews combined with Featured Snippets now consume 75.7% of screen space. On desktop, it’s 67.1%. Even if you rank Position 1, you’re pushed below the fold on mobile devices.

The click-through rate collapse tells the real story. Normally, Position 1 on desktop commands a 13% CTR. With an AI Overview present, that drops to less than 5%. On mobile, it plummets from 20% to 7%.

Position 2 saw a 39% year-over-year CTR decline. Positions 1-5 average a 17.92% CTR drop overall.

News.com.au traffic data revealing the sharp decline following AI Overview implementation

Real-world example: MailOnline’s traffic for the query “Noor Alfallah news” collapsed from 6,000 clicks to 100 clicks when an AI Overview appeared. That’s a 98% drop for a single query. Multiply that across thousands of keywords and you understand why publishers are panicking.

Revenue Impact: From Traffic to Bankruptcy

Traffic losses translate directly to revenue destruction. Australian lifestyle publisher Man of Many reported informational content traffic down 10-30%. US-based Penske Media, which filed a lawsuit against Google in September 2025, saw affiliate revenue plummet more than 33% from its 2024 peak.

Business Insider cut 21% of staff in May 2025, explicitly citing “uncontrollable” search traffic drops. The New York Times watched its search traffic share fall to 36.5% in April 2025. HuffPost’s organic search traffic was cut in half over three years.

Daily Telegraph traffic estimation showing consistent decline pattern

These aren’t minor corrections. These are existential threats to business models built over two decades.

AI Mode: The Second Wave That Could Finish the Job

Just when publishers thought it couldn’t get worse, Google launched AI Mode in Australia on October 8, 2025. This isn’t an incremental update. It’s a complete reimagining of search that threatens to push zero-click rates from 69% to 90%.

AI Mode uses a custom Gemini 2.5 model with multimodal search capabilities. Users can ask questions via text, voice, or by uploading images. The system breaks complex queries into multiple sub-questions and sources answers from across the web, then synthesizes everything into comprehensive summaries.

Early data from US users shows query length has tripled compared to traditional searches. Users are asking longer, more complex questions and getting detailed answers without ever clicking through to a single website.

“Google’s AI Mode will reshape how the internet works in Australia. It could quietly rewrite the web’s entire traffic economy. The world’s biggest advertising engine is learning how to answer questions without sending users anywhere.” – Ori Gold, CEO, Bench Media

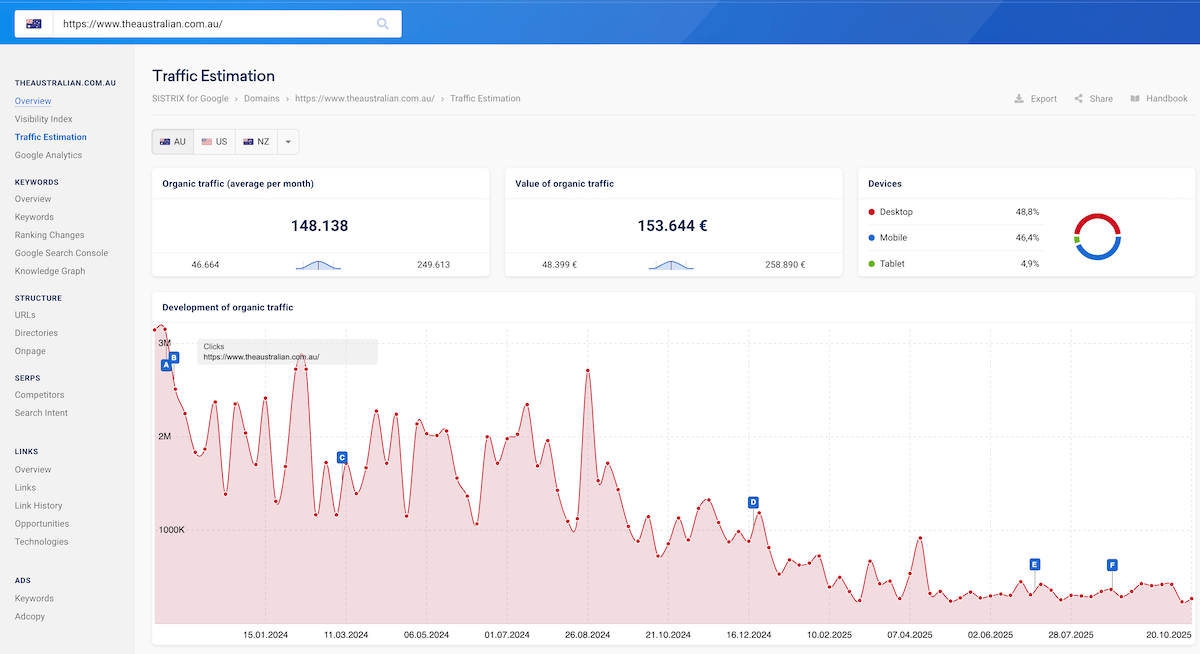

The Australian traffic data showing the broadening impact across premium publishers

Here’s what should terrify every publisher: in markets where AI Overviews launched, zero-click searches jumped from 56% to 69%. With AI Mode, industry experts predict up to 90% of sessions will end without a click-through.

That’s not a search engine anymore. That’s a content consumption platform that happens to scrape everyone else’s work.

Publisher Survival Strategies: What’s Actually Working

Enough doom. Let’s talk about what Australian publishers are doing to survive this. Because some are adapting, and their strategies offer a blueprint for everyone else.

Scott Purcell’s men’s lifestyle publisher Man of Many saw the writing on the wall early and pivoted hard. Here’s exactly what they did:

- Registration wall: Limited free access to 3 articles per week, forcing users to register for continued access

- Newsletter verticals: Launched 8 targeted newsletters covering cars, watches, tech, fashion, and other specific interests

- Email growth: Added close to 10,000 registered users since launch, bringing total email subscribers to 130,000

- AI bot monitoring: Partnered with Tollbit to track and measure AI crawler traffic

- Alternative AI deals: Struck a revenue-share agreement with Pro Rata, an AI-powered search engine that actually pays publishers

- Podcast expansion: Launched new podcast series to diversify beyond written content

“Publishers must pivot from being search-dependent to becoming unforgettable brands with direct audience relationships. The fight is no longer just for a top spot on Google. It’s for a spot in a reader’s daily habit.” – Scott Purcell, Co-founder, Man of Many

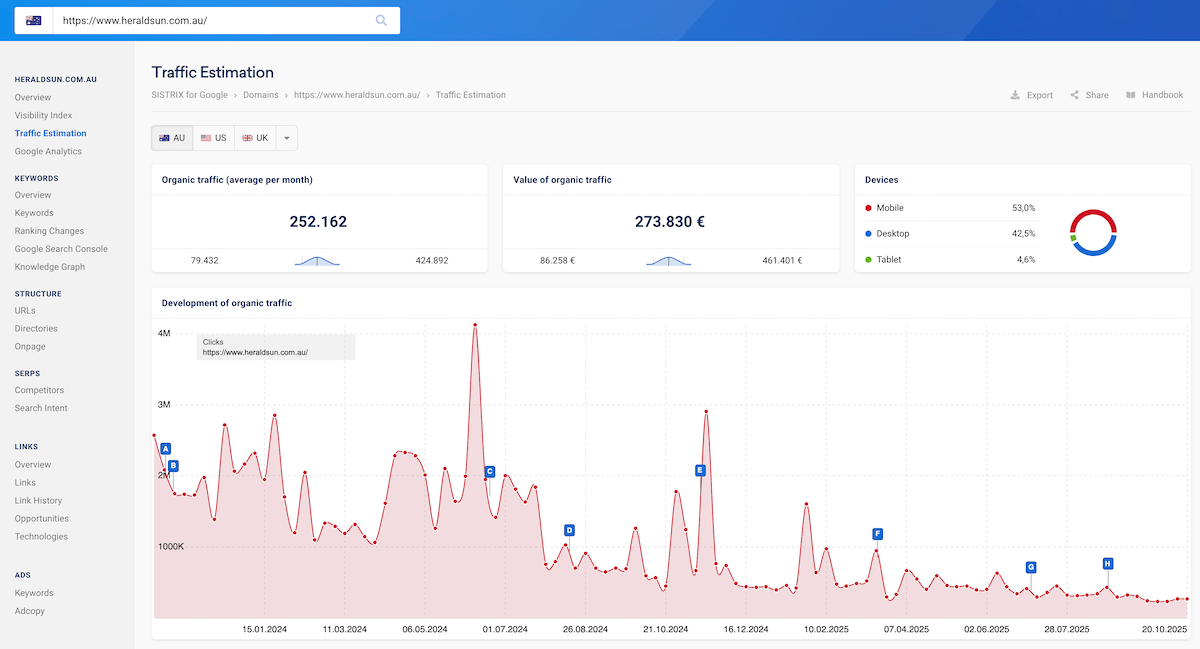

Herald Sun traffic patterns reflecting broader industry challenges

The Guardian took a different approach, building a reader-supported model that now accounts for 64% of total revenue through subscriptions and one-off payments. Their strategy:

- Newsletter army: 12 newsletters, with 5 sent every weekday to maintain daily touchpoints

- Podcast investment: Heavy expansion into audio content that’s harder for AI to scrape and summarize

- Dual revenue model: Combining reader support with advertising creates resilience against single-channel disruption

“Our dual revenue model isn’t just sustainable, it’s enabling us to grow while others struggle.” – Rebecca Costello, Managing Director, Guardian Australia

Legal Resistance: Publishers Fight Back

Some publishers aren’t adapting quietly. They’re lawyering up.

In September 2025, Penske Media Corporation, parent company of Rolling Stone, Billboard, and Variety, filed a lawsuit against Google. Their claims are damning: Google’s AI Overviews use content without consent and have slashed traffic so severely that affiliate revenue dropped more than 33% from its peak.

Penske alleges that about 20% of Google searches linking to their sites now display AI Overviews, a figure they expect will only rise. The lawsuit paints publishers into an impossible corner: block Google from indexing your articles and you disappear from search entirely, or allow indexing and watch Google cannibalise your traffic.

Google’s response? “With AI Overviews, people find Search more helpful and use it more, creating new opportunities for content to be discovered. We will defend against these meritless claims.”

The News Media Alliance, representing over 2,200 publishers, isn’t buying it. CEO Danielle Coffey called Google’s behaviour “the definition of theft” and noted that Google’s market power means it doesn’t have to “engage in those healthy practices” that other AI companies negotiate.

SEO Adaptation Playbook for Australian Publishers

Legal battles take years. You need strategies that work today. Here’s what the data shows actually increases your chances of being cited in AI Overviews and capturing the remaining clicks.

AI Citation Optimization: What Actually Gets You Cited

Research shows 75% of AI Overview citations come from websites ranking in the top 12 organic positions. But ranking alone isn’t enough anymore. Your content needs specific structural elements.

Content Type Vulnerability Matrix: What’s Safe, What’s Dying

Not all content is equally vulnerable. Understanding which types get cannibalized by AI Overviews versus which remain citation-worthy determines your editorial strategy.

Most Vulnerable (High AI Overview Trigger Rate):

- How-to guides and tutorials

- Product reviews and comparisons

- Recipe and cooking instructions

- Evergreen informational content

- Definition and explanation articles

Safer Categories (Lower Cannibalization):

- Breaking news and developing stories

- Original investigations with exclusive data

- Long-form features and analysis

- Exclusive interviews

- Local WA stories with unique regional data

Kevin Indig, a leading US SEO expert who analysed global SimilarWeb data, confirmed: “Looking deeper into the data, the conclusion I’ve come to is that the news side of the house is fine. Where everybody’s seeing a drop is with evergreen content.”

The strategic implication is clear: shift your content mix from evergreen how-to guides toward original reporting, breaking news, and locally-focused stories that AI can’t easily replicate.

Direct Audience Building: The 60-Day Emergency Plan

Search traffic is dying. Direct relationships are the lifeboat. Here’s what you need to implement in the next 60 days.

Emergency Traffic Audit

- Export Google Search Console query data for past 90 days

- Filter for queries triggering AI Overviews (look for massive CTR drops)

- Identify your most vulnerable content categories

- Map revenue impact by content type

Quick Wins Implementation

- Add FAQ schema to top 20 traffic pages

- Update all author bios with credentials and expertise

- Refresh top 50 pages with 2025 data and statistics

- Install registration wall plugin (recommend 3-5 free articles/week)

Email Capture Infrastructure

- Create 3-5 topic-specific newsletter signup forms

- Add exit-intent popups with exclusive content offers

- Launch dedicated newsletter landing pages

- Set up automated welcome email sequences

Content Strategy Rebalance

- Shift to 60% original local reporting (AI-resistant)

- Maintain 30% evergreen optimized for AI citations

- Experiment with 10% multimedia (podcasts, video)

- Launch at least one weekly podcast series

Man of Many added close to 10,000 registered users using this exact playbook. Guardian Australia now derives 64% of revenue from reader-supported models. You don’t need to invent new strategies. You need to execute the proven ones before your competitors do.

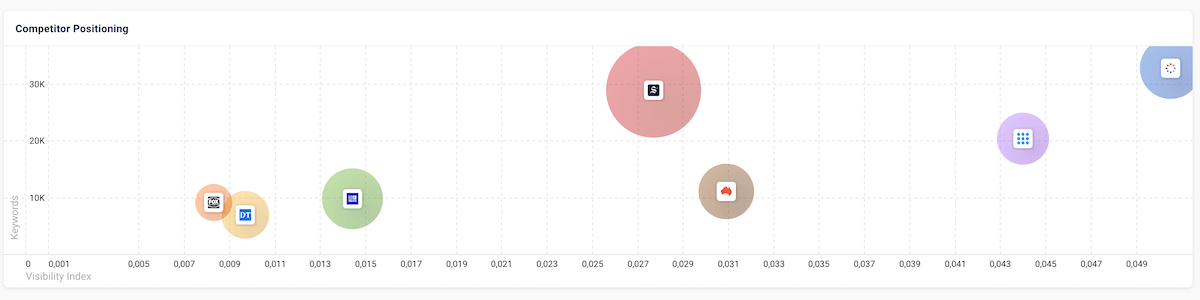

Competitive landscape showing relative positioning of Australian news publishers

Western Australia: The Local News Advantage

Here’s where Perth publishers actually have an edge over their eastern counterparts. Local news is inherently harder for AI to replicate, and Western Australia’s geographic isolation creates unique coverage gaps that national publishers can’t cost-effectively fill.

Why AI Struggles with Local WA Content

AI Overviews work by synthesizing information from multiple accessible sources. But local content often exists behind barriers that AI models can’t easily overcome:

- Paywall-protected council documents: City of Perth planning applications, council meeting minutes, local government decisions

- State court filings: WA Supreme Court and Magistrates Court documents require specific access

- Exclusive government briefings: State government press conferences and ministerial announcements

- Regional community stories: Events, achievements, and issues in regional WA that national outlets ignore

- WA-specific regulations: State legislation, mining regulations, and local business compliance requirements

National publishers like Nine, Seven, and News Corp simply can’t afford journalists in every WA council chamber or at every state government briefing. That coverage gap is your competitive moat.

The Perth Publisher Action Plan

If you’re a WA news publisher, your survival strategy should lean heavily into hyperlocal, data-driven original reporting that AI can’t touch.

Data Journalism Focus:

- WA crime statistics analysis by suburb and category

- Perth property market deep-dives using exclusive real estate data

- State budget impact reports on specific WA industries

- Infrastructure project tracking with local contractor interviews

- Mining project approvals and economic impact analysis

Exclusive Access Opportunities:

- State government press gallery coverage

- WA business executive interviews and profiles

- Local community organization features

- Perth event coverage and cultural reporting

- Regional WA development stories

Subscription Model Positioning:

- Position as “essential WA news” rather than general Australian news

- Member-supported journalism model emphasizing community investment

- WA business intelligence premium tier for corporate subscribers

Example Headlines That Work for WA Publishers

Here are real examples of story angles that drive traffic, resist AI cannibalization, and build subscriber loyalty:

- “Kwinana Freeway Upgrade: $700M Project’s Impact on Southern Suburbs Property Values”

- “Perth’s Housing Crisis: Exclusive Council Data Shows 40% Planning Approval Delay Increase”

- “WA Mining Boom 2.0: How Lithium Projects Will Transform Regional Employment in Goldfields”

- “Inside the Numbers: Why Perth’s CBD Office Vacancy Rate Jumped 12% in Six Months”

- “State Budget 2025: Line-by-Line Analysis of Winners and Losers for WA Businesses”

Notice what these have in common: specific data points, local geographic focus, and original analysis that requires actual reporting work. AI can’t generate these stories because the underlying data isn’t freely available on the open web.

The Broader Australian Media Crisis

The AI traffic collapse is hitting an industry already on life support. Understanding the broader context explains why this moment is so critical.

In the past decade, 166 Australian news outlets closed their doors. That’s three times more closures than the decade before. The News Media Bargaining Code, which was supposed to force tech platforms to pay for news content, effectively collapsed when Meta pulled Australian news from Facebook in 2024.

Google now controls 94% of Australia’s search market. There’s no meaningful alternative. When the platform that drives half to two-thirds of your traffic fundamentally changes how it operates, you don’t have leverage to negotiate. You adapt or you die.

Meanwhile, 23% of Australians now use social media as their primary news source, bypassing traditional news websites entirely. The audience is fragmenting at the exact moment when the primary traffic driver is pulling the rug out.

Regulatory Response: Too Little, Too Late?

The Australian Competition and Consumer Commission is monitoring the situation and considering whether AI companies should pay fair compensation to publishers. But regulatory action takes years, and publishers need solutions today.

Some technological solutions are emerging. In July 2025, Cloudflare launched a trial of an automated system that allows content owners to charge AI crawlers for access. Google signed a licensing deal with Australian Associated Press in August 2025 for AI training content, but these deals favour large publishers and leave independent regional outlets in the cold.

“We are witnessing an acceleration of platform monopolisation and concentration of power, now fuelled by AI technologies, and this is deepening the crisis of journalism. If press publishers are driven out of the market by worsening platform monopolies, we risk losing diverse perspectives, marginalised voices, and investigative reporting.” – Dr Joanne Kuai, RMIT Researcher

The Silver Lining: Quality Over Quantity

Not everything about this shift is apocalyptic. Buried in the data is a surprising finding that offers hope for publishers willing to adapt.

The Conversion Rate Paradox

Traffic from AI-generated summaries converts better than traditional SERP listings. Users who do click through after reading an AI Overview arrive more educated, with higher intent, and ready to take action.

Old Model vs New Model

Old Model: 100 random visitors → 2 conversions (2% rate)

New Model: 30 qualified visitors → 6 conversions (20% rate)

Better conversion efficiency despite lower volume

This means the game is shifting from attracting maximum eyeballs to capturing highly qualified visitors. Your monetization strategy needs to reflect higher per-visitor value.

Brand Authority Signal

Being cited in an AI Overview is a massive trust signal. Users see your brand name, your expertise, and your authority before they even consider clicking. When they do click, they arrive with pre-built trust.

Data shows branded keyword searches trigger AI Overviews that boost click-through rates by 18.7% compared to standard search results. The visibility alone builds brand equity.

First-movers who optimize for AI citations now are building competitive moats. When your site consistently appears in AI Overviews for key topics in your niche, you become the recognized authority. Late adopters will struggle to displace you.

Your 60-Day Action Plan: Survive or Disappear

Theory is useless without execution. Here’s exactly what you need to do, starting today.

Week 1: Immediate Emergency Tactics

Days 8-30: Medium-Term Strategic Pivots

Content Strategy Rebalance: Shift your editorial calendar immediately. Aim for 60% original local reporting that AI can’t replicate, 30% evergreen content optimized for AI citations, and 10% experimental formats like podcasts and video.

Newsletter Infrastructure: Launch at least 3 topic-specific newsletters. Don’t create a generic “daily digest.” Create targeted newsletters for specific reader interests: WA business news, Perth property, local politics, regional development, etc.

Monetization Diversification: If you’re 100% reliant on display advertising, you’re in trouble. Launch a paid newsletter tier, create a sponsored content program with clear disclosure, and explore membership models with exclusive perks.

Technical SEO Audit: Implement comprehensive schema markup beyond just FAQs. Add Article schema, Author schema, Organization schema. Build internal linking clusters around topic hubs. Create conversational long-tail landing pages that match natural language queries.

Days 31-60: Long-Term Positioning

Podcast Launch: Audio content is significantly harder for AI to scrape and summarize effectively. Start with one weekly podcast in your core content area. Equipment can be basic. Consistency matters more than production value initially.

YouTube Strategy: Video journalism creates another content format that’s more difficult for AI Overviews to cannibalize. Start with simple talking-head commentary on your written stories, then expand to original video reporting.

Community Building: Launch a comments section or discussion forum. Create a Slack or Discord group for subscribers. Host monthly webinars or Q&A sessions. The goal is to build a community that comes to you directly, not through Google.

Data Journalism Investment: This is especially critical for WA publishers. Build proprietary datasets around Perth property, WA crime statistics, state government spending, infrastructure projects, or business data. Original data creates AI-resistant content that drives citations and subscriber value.

Platform Independence: Start optimizing for alternative search engines. Bing’s market share is small but growing. DuckDuckGo and Perplexity represent potential traffic sources. Don’t put all your eggs in Google’s basket anymore.

Conclusion: The Next 60 Days Determine the Next 10 Years

Let’s strip away the noise and focus on what matters.

Google’s AI Overviews have already cut Australian publisher traffic by up to 35% in just 12 months. AI Mode, which launched October 8, 2025, will accelerate that decline toward 90% zero-click rates. Publishers that haven’t diversified away from search dependence are facing bankruptcy.

But this crisis creates opportunity for those willing to move fast. The publishers building direct audience relationships, investing in original local reporting, and optimizing for AI citations right now will not only survive but will capture market share from competitors that disappear.

Key Takeaways:

- The cliff is real: 35% traffic losses are happening now, documented by SimilarWeb data

- AI Mode accelerates the crisis: 90% zero-click projection threatens remaining traffic sources

- Winners will emerge: Publishers building email lists, subscriptions, and AI citation authority will thrive

- WA has an advantage: Local data-driven original reporting is inherently AI-resistant

- Time is short: You have 60-90 days to implement core adaptations before another wave hits

For Western Australian publishers specifically, your geographic isolation and focus on local stories creates a natural moat against AI cannibalization. National publishers can’t afford to cover Perth councils, WA courts, and regional development stories. That’s your competitive advantage. Double down on it.

For SEO agencies and consultants, your clients need to hear the truth: traditional SEO strategies built around ranking in position 1 are dying. Redirect your efforts toward AI citation optimization, direct audience building, and content format diversification.

For advertisers and brands, it’s time to reassess which publishers you’re backing. Look at their email subscriber counts, their direct traffic numbers, and their reader-supported revenue models. Search traffic is no longer a reliable proxy for publication health.

The publishers who treat this as just another algorithm update will fail. The ones who recognize this as a fundamental restructuring of the web’s traffic economy and act accordingly will be the survivors telling war stories in five years.

The clock is ticking. What are you going to do in the next 60 days?