Digital Transformation in Perth’s Mining and Manufacturing Industries

Perth, Western Australia’s capital and economic hub, stands at the forefront of Australia’s mining sector while ambitiously advancing its manufacturing capabilities.

The region’s economy relies heavily on mining, which accounts for 44% of Western Australia’s Gross State Product [1], alongside a growing advanced manufacturing base representing approximately 4% of GSP. Digital transformation has become essential for sustainable growth in these sectors, with technologies such as automation, artificial intelligence, Internet of Things, blockchain, cloud computing, and advanced data analytics reshaping industrial operations.

These innovations deliver improvements in productivity, safety, and global competitiveness, though they also introduce challenges including cybersecurity risks and workforce disruption.

This research explores Perth’s evolving mining and manufacturing sectors, examines key technological trends, compares Perth’s progress with other Australian regions, and evaluates the economic and workforce impacts of this transformation.

Perth’s Mining Industry: Embracing Digital Technologies

Western Australia’s mining industry has established itself as a global leader in adopting technology-driven innovation, with Perth serving as the nerve center for numerous high-tech mining operations.

Automation and Robotics

WA has pioneered the use of autonomous machinery in mining. The state’s iron ore giants have deployed hundreds of autonomous haul trucks and dozens of autonomous drilling rigs, primarily in the Pilbara region. These driverless trucks and robotic drills are supervised from sophisticated remote operations centers in Perth.

BHP’s Integrated Remote Operations Centre (IROC) in downtown Perth has been operating continuously for over a decade, controlling mine sites, rail networks, and port operations from 1,300 km away [2]. This facility has significantly improved safety and efficiency, with BHP reporting that its iron ore operations are safer and more cost-efficient than a decade ago thanks largely to remote automation [2]. While some sites still use manned equipment, BHP aims to achieve “autonomous load and haul operations across all of our operations” by the mid-2020s [2].

Similarly, Rio Tinto operates a substantial autonomous truck fleet; in 2018, approximately 20% of its 400 haul trucks in the Pilbara were self-driving. This percentage has dramatically increased to 84% by 2024 [3], contributing to zero truck-related injuries over ten years and 15% lower unit costs compared to manual trucks.

These achievements underscore Perth’s global leadership in mining automation, as few other regions have automated at such scale. Mining companies are also exploring robotics for dangerous tasks, with WA’s new Automation and Robotics Precinct providing testbeds for mining robots and autonomous vehicles [4].

Artificial Intelligence and Analytics

AI, machine learning, and big data analytics are being leveraged to optimise exploration, operations, and maintenance. The mining sector ranks as Australia’s second-highest user of big data analytics by industry. Companies deploy AI for mineral exploration (analysing geological data to find deposits), predictive maintenance on equipment, and optimising haul routes and processing plant throughput.

At Gold Fields’ Granny Smith gold mine northeast of Perth, digital transformation underground has included installing a private LTE (4G) network to enable real-time data from drills and vehicles, and implementing an AI-powered fleet management system [5]. This allows managers to have live visibility of people and equipment deep underground, improving scheduling and responsiveness. Early results show potential productivity gains up to 30% in underground operations when manual, paper-based scheduling is replaced with AI-driven optimisation [5].

Across the industry, digital twins (virtual models of mining processes) and advanced analytics are being tested to simulate scenarios and improve decision-making, with the WA mining sector recognised as a leading adopter of digital twin technology. These innovations help miners operate safer, smarter, and cleaner by simulating mine plans for better safety and productivity outcomes.

IoT and Connectivity

IoT sensors and connected devices are widespread in modern mines for monitoring equipment, environmental conditions, and worker safety. The resources sector is Australia’s third-highest user of Internet of Things devices by industry, reflecting the extensive deployment of sensors on haul trucks, conveyors, and processing plants.

Western Australia’s vast and remote mining operations have driven investment in connectivity – from private 4G networks in underground mines to satellite and long-distance Wi-Fi links at remote sites. Reliable digital connectivity is now considered essential infrastructure for mining as it enables telemetry, automated control, and drone surveys in real time.

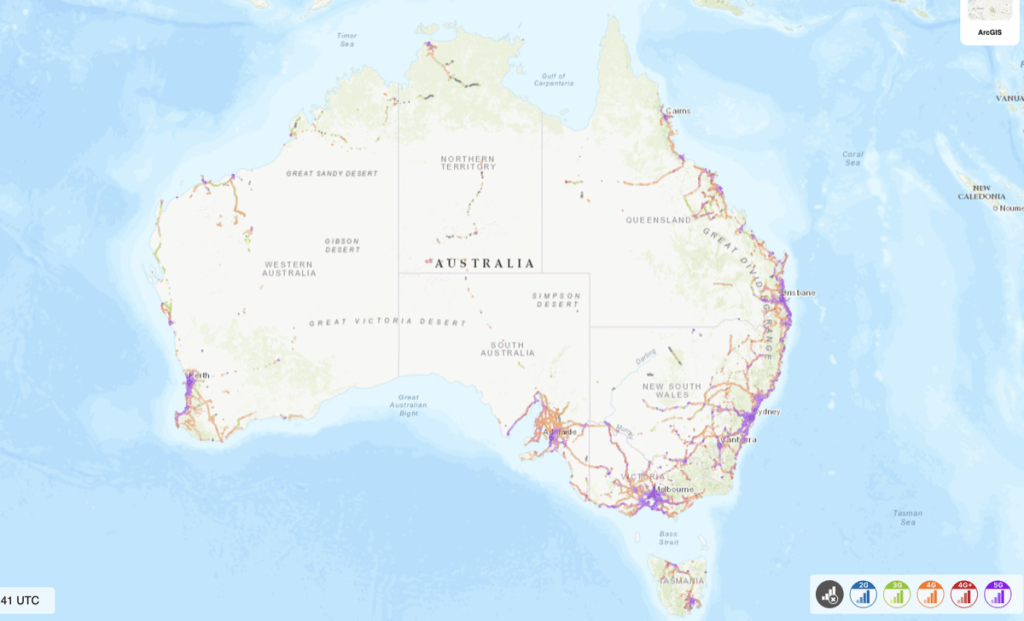

One challenge remains the patchy telecom coverage in some of WA’s remote regions. Mining companies often build their own networks to compensate, as Gold Fields did with an LTE network to transmit data from deep underground.

The WA government and industry recognise that improving digital infrastructure is critical to fully utilise IoT and remote operations statewide. Nonetheless, Perth’s mining sector has demonstrated that with appropriate connectivity investments, even mines hundreds of kilometers away can be operated with a “digital thread” linking them to city-based control centers.

Blockchain and Cloud in Mining

Mining companies are beginning to explore blockchain for supply chain transparency and efficiency. A notable example is BHP’s trial of blockchain trading: in 2020, BHP completed its first blockchain-based iron ore transaction with a Chinese steelmaker, and in 2021 it executed a $30 million copper concentrate trade via a blockchain platform [6].

These pilots, conducted from Perth in partnership with technology providers, aimed to digitise the traditionally paper-heavy minerals trading process.

Blockchain allows secure tracking of ore shipments, assay data, and even sustainability credentials in a tamper-proof ledger [6]. Industry experts in WA have urged local mining and energy firms to adopt blockchain more broadly to “track and trace resources throughout the supply chain from source to end use,” noting that Europe’s resource companies have moved faster on this innovation than those in Western Australia [7].

Cloud computing underpins much of mining’s digital transformation – from storing massive datasets collected by IoT sensors to enabling remote access to operational software. Perth has positioned itself as a global data hub due to its strategic location and submarine fiber connections, aiming to attract data centers serving mining and other industries.

Major miners partner with cloud providers to analyse data for AI models and ensure mine data is accessible securely from anywhere. This cloud-enabled flexibility proved crucial during the pandemic and continues to support remote working arrangements.

Cybersecurity in Mining

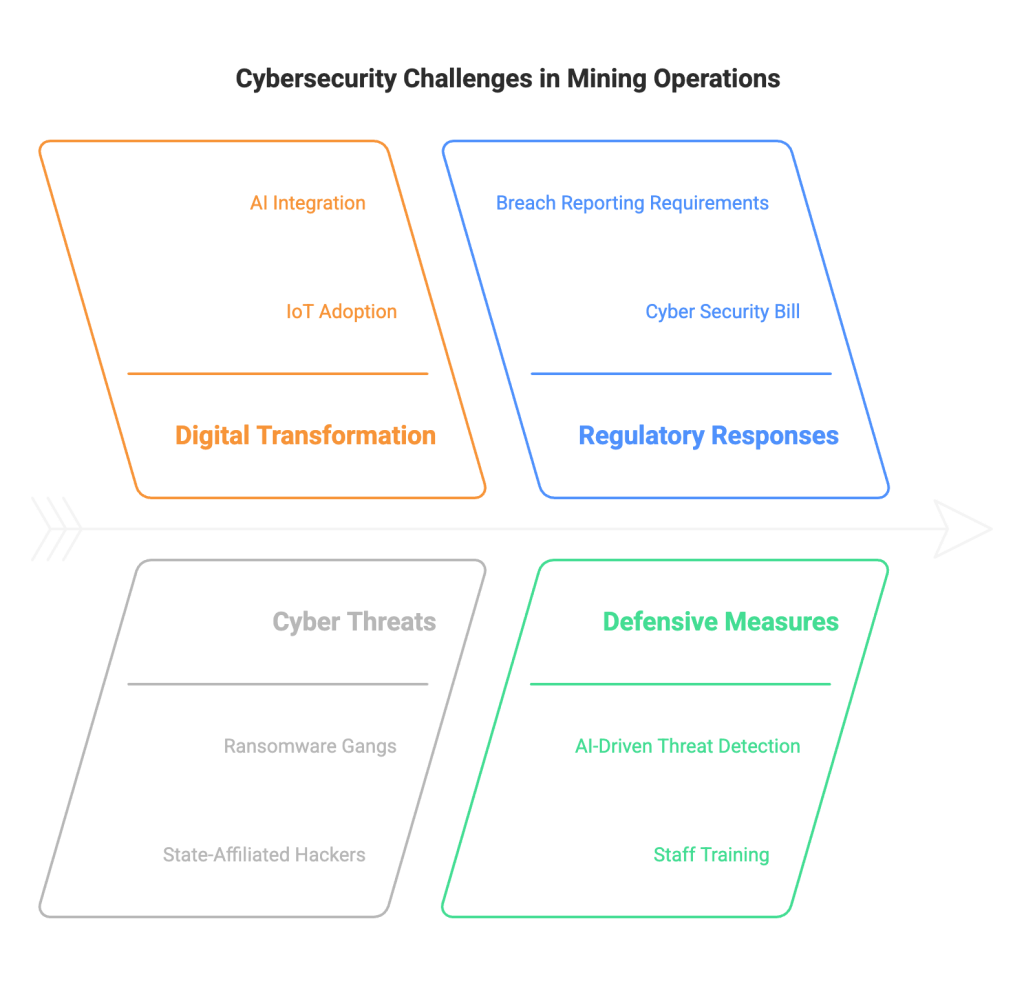

As mining operations digitalise, they have become targets for cyber-attacks, making cybersecurity a top-of-mind aspect of digital transformation. According to Australia’s cyber intelligence agency, one cyber-attack is reported every six minutes nationwide, with large businesses averaging losses of approximately A$72,000 per incident [8].

WA’s mining sector has not been spared: high-profile breaches have affected companies like Rio Tinto (in 2023 hackers accessed sensitive employee and corporate data) and Northern Minerals [8].

Alarmingly, 40% of mining equipment, technology, and services (METS) businesses in Australia suffered some form of cyber-attack in the past year [8], indicating widespread risk. Threat actors range from ransomware gangs encrypting operational systems to state-affiliated hackers targeting intellectual property.

The government has responded by tightening cyber regulations – Australia introduced a standalone Cyber Security Bill in 2024 requiring companies to improve breach reporting and security standards. In Western Australia, the state is also reviewing cyber capabilities for critical sectors like energy and mining.

Mining companies are strengthening defenses by investing in AI-driven threat detection, segmenting IT/OT networks, and training staff to prevent phishing. The ongoing competition between defenders and attackers continues as miners adopt new technologies and criminals exploit new vulnerabilities [8].

Ensuring robust cybersecurity has thus become a business imperative alongside the adoption of IoT, AI, and cloud in Perth’s mining ecosystem.

Remote Operations Flagship

A quintessential example of Perth’s mining digital transformation is the Australian Automation and Robotics Precinct (AARP), a new hub north of Perth. Opened in late 2024, AARP is one of the largest test facilities of its kind, built with a $28 million investment to support autonomous and robotic systems R&D [4]. It provides test beds where mining companies can trial self-driving vehicles, drone systems, and remote operation technology in a controlled environment.

The WA government projects AARP will contribute $450–$600 million in economic benefits by 2030 through faster adoption of robotics across industries [4]. This precinct reinforces WA’s status as a global leader in mining innovation and facilitates cross-industry technology transfer.

The state also hosts the Australian Space Automation, AI and Robotics Control Complex (SpAARC) in Perth, leveraging mining remote-operation expertise for space applications. These initiatives highlight how Perth’s mining sector digitalisation is fostering a broader technology ecosystem that strengthens WA’s competitive edge.

Case Study: Roy Hill and Epiroc Collaboration: Pioneering Autonomous Mining

Roy Hill, in partnership with Epiroc and ASI Mining, is leading a groundbreaking project to convert its fleet of 96 conventional haul trucks into an autonomous fleet, establishing the world’s largest single autonomous mine.

Announced in January 2023, this AUD 70 million initiative is being implemented in stages with expected completion by 2025. The diverse fleet, comprising 54 Caterpillar 793F trucks and 42 Hitachi trucks, operates using ASI Mining’s Mobius traffic management system.

By March 2023, 10 autonomous trucks were already operational within a dedicated zone, with more than 200 modified ancillary vehicles being integrated to work alongside the autonomous fleet.

Beyond technological advancement, Roy Hill has introduced comprehensive reskilling programmes to transition workers into new roles suited for an automated environment. The Remote Operations Centre in Perth oversees the entire system, reinforcing Western Australia’s position as a global leader in mining automation and innovation.

This project is expected to reach completion by the end of 2025, according to sources at Epiroc Australia.

Perth’s Manufacturing Sector: Advancing through Industry 4.0

Western Australia’s manufacturing industry, while smaller in scale than mining, is undergoing a strategic shift towards advanced, technology-driven production. The WA government views advanced manufacturing as a “critical enabler” to diversify the state’s economy beyond raw resources.

Automation and Industry 4.0

Many Perth manufacturers are adopting Industry 4.0 practices – integrating cyber-physical systems, robotics, and real-time data into their factories [9]. A remarkable 56% of Australia’s manufacturing businesses adopted new technologies in the past year (2023–2024) [10], a trend mirrored in WA as firms modernise to maintain competitiveness.

Key technologies include industrial robotics for precision and efficiency, IoT sensors on production lines for monitoring and optimisation, and automation of repetitive tasks. Local manufacturers in sectors like metal fabrication or equipment assembly are introducing robotic welding and automated guided vehicles to boost productivity.

A recent industry survey found 35% of “production” businesses have implemented AI systems, 20% use machine learning, and 17% have deployed IoT solutions to streamline operations [11]. These tools help reduce errors and downtime – and notably, 90% of manufacturers who adopted AI report being satisfied with the outcomes, citing improvements in efficiency and decision-making.

One illustrative case is Perth’s emerging role in subsea robotics manufacturing: the opening of a large subsea robotics R&D facility in Balcatta, Perth, by an Australian company is accelerating the development of autonomous underwater vehicles and related manufacturing. This high-tech manufacturing combines automation, AI, and advanced assembly techniques, exemplifying the shift towards smarter production.

Data Analytics and AI in Manufacturing

Perth manufacturers are increasingly leveraging data analytics and AI for quality control, supply chain management, and product innovation. Through IoT-based systems, factories collect real-time data from machines and sensors, which is then analysed to identify inefficiencies or predict maintenance needs.

AI-driven analytics can detect anomalies in a processing plant’s output and alert managers before a defect becomes costly. In advanced materials manufacturing (such as lithium battery components, an emerging WA industry), AI models optimise complex chemical processes and improve yields.

Cloud computing provides scalable computing power and enables remote collaboration – engineers in Perth can remotely monitor factories in regional WA or control equipment via cloud-based interfaces. This capability became especially important during COVID-19, and many companies have maintained a level of remote/digital operation.

Digital twins are making inroads in manufacturing design; virtual models of production systems allow firms to simulate changes or new product lines digitally before physical implementation, saving time and cost. Western Australia’s push for Industry 4.0 is supported by institutions like the UWA Industry 4.0 Energy TestLab, which helps companies trial IoT and analytics solutions for manufacturing challenges.

Blockchain in Supply Chains

Secure supply chains are vital for manufacturing, especially for exporters and those in defense or critical minerals. Perth-based manufacturers, often part of global supply networks, are experimenting with blockchain for traceability of parts and materials.

Blockchain can record each step of a product’s journey – useful for proving origin of critical minerals or ensuring authenticity of aerospace components. While still in early stages, interest is growing; mining-linked manufacturers see blockchain as a way to guarantee ethical sourcing and improve supply chain transparency and trust.

A local example involves WA’s rare earth element supply chain: companies are looking at blockchain to track rare earths from mining through processing to export, to assure buyers of responsible production. The integration of blockchain with IoT is being piloted in logistics between Perth’s manufacturers and the port of Fremantle, aiming to reduce paperwork and enhance efficiency.

These innovations often build on national initiatives; Australia’s largest shipping and logistics firms have trialed blockchain bills of lading, and Perth companies are beginning to join such platforms.

Cybersecurity for Manufacturing

As factories digitalise, they too face cyber threats. Many WA manufacturers are small or medium enterprises with limited IT staff, making them potentially vulnerable. The increased connectivity opens new attack surfaces.

A lack of cybersecurity expertise was cited as a barrier by some firms adopting digital tech – concerns about cyber incidents ranked alongside financial constraints as a key challenge to successful digital transformation. High-profile attacks on critical infrastructure have served as wake-up calls.

In response, industry groups and government in WA have been promoting cybersecurity awareness in manufacturing, offering guides on protecting industrial control systems and encouraging certification to standards. The goal is to ensure that as factories embrace IoT and cloud, they also implement proper firewalls, network segmentation between corporate and factory networks, and regular security audits.

The connection between mining and manufacturing cybersecurity is also recognised – many equipment manufacturers supply to miners, so a breach in a supplier could affect a mining client. Hence, securing the entire value chain is crucial.

The WA government’s Digital Economy Strategy emphasises “digitally secure” businesses as part of its vision, underscoring that cybersecurity is an integral component of digital transformation for all industries.

Policy Support and Local Initiatives

Government policy in WA strongly supports manufacturing digitalisation. In 2024, the state launched “Western Australia: Advancing the Future of Manufacturing,” a prospectus outlining plans to grow advanced manufacturing through technology adoption.

Priority areas include leveraging WA’s strengths in remote operations, critical minerals processing, and defense manufacturing. WA’s strategic abundance of battery minerals is being paired with advanced manufacturing techniques to move up the value chain – such as building battery component plants and industrial facilities for lithium hydroxide processing with cutting-edge automation.

The government aims to create an environment conducive to high-tech manufacturing by investing in infrastructure and innovation hubs. One flagship is the Rockingham Manufacturing Hub, focusing on automation in maritime and defense manufacturing, and another is the planned South West advanced manufacturing hub to support tech adoption in regional industries.

Compared to traditional manufacturing centers in eastern Australia, Perth’s approach is to carve out high-tech niches: aerospace and defense technology and space industry manufacturing. By fostering these specialisations, Perth seeks to compete – recognising that states like Victoria and New South Wales historically had larger manufacturing workforces, but the future of manufacturing will focus on advanced capabilities rather than volume.

WA’s share of national manufacturing is modest, but WA’s mining equipment, technology and services (METS) sector constitutes about 30% of Australia’s METS industry, indicating a strong existing base of tech-oriented industrial firms that can pivot into broader advanced manufacturing markets.

Cross-State Comparisons and Policy Landscape

Perth Compared to Other Australian Regions

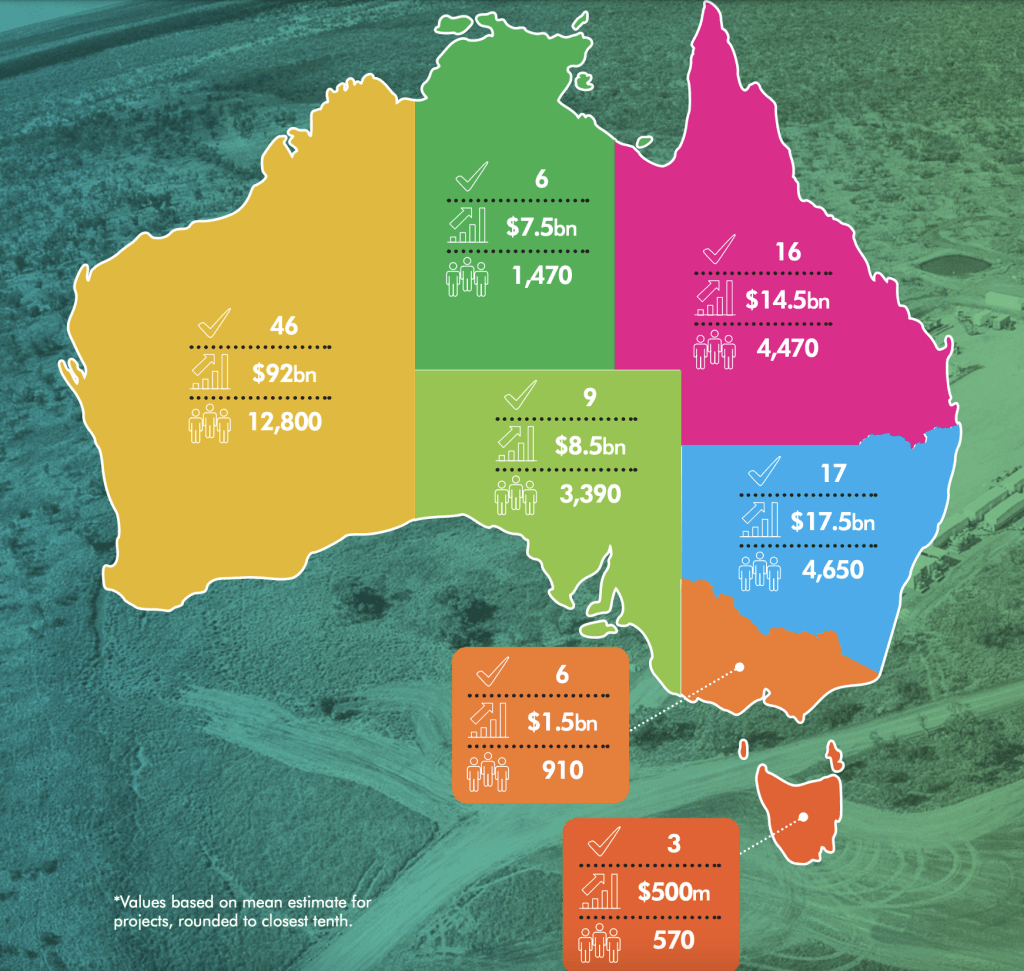

Perth and Western Australia exhibit unique leadership in certain aspects of digital transformation due to the state’s economic profile. In mining, WA is unmistakably ahead in automation and remote operations compared to other Australian states.

The Pilbara mines are a world-leading example of digitised mining – something not yet replicated in Queensland’s coal fields or New South Wales’ mines to the same extent. Queensland and NSW mining companies are adopting digital technologies, but WA’s early investment in autonomous haulage and centralised control has set it apart [2].

By 2023, WA had the vast majority of Australia’s autonomous mining trucks and a dedicated robotics testing precinct, whereas other states are only beginning to trial such large-scale autonomy. This gives Perth a knowledge advantage and exportable expertise, with WA’s mining technology companies often serving interstate and overseas operations.

In manufacturing, eastern states like Victoria and NSW have larger advanced manufacturing ecosystems in areas like biomedical manufacturing or food processing, partly due to their bigger population and industrial base. However, WA is rapidly catching up in targeted fields.

The state’s remote operations expertise is being applied to fields like remote asset management in agriculture and oil & gas, where WA companies can lead nationally. Moreover, WA’s focus on critical minerals processing and battery value-chain manufacturing aligns with national priorities for onshore value-adding.

Government Strategies and Collaboration

At both state and federal levels, policies are influencing Perth’s digital transformation journey. WA’s Diversify WA economic framework explicitly aims to diversify beyond mining by accelerating digital uptake across industries.

The Digital Industries Acceleration Strategy (2024) envisions WA businesses being “digitally secure, enabled and empowered,” and commits to actions like boosting cybersecurity capabilities and supporting SMEs in technology adoption. The state government has also co-invested in innovation infrastructure – beyond AARP, there’s support for the Curtin University-led Trailblazer initiative on Resources Technology, and partnerships with CSIRO on mining automation research.

Federally, the Australian government’s $15 billion National Reconstruction Fund prioritises areas including resources value-adding and critical technology manufacturing, which aligns with projects in WA. Policy settings in skills and education also play a role: WA has recognised the need for a pipeline of STEM talent and has programs to reskill workers for digital roles.

When comparing with other states, WA’s policy emphasis on remote operations and mining technology is distinctive, while states like South Australia have focused on defense manufacturing and Queensland on robotics for agriculture. Still, there is convergence in recognising Industry 4.0’s importance nationwide.

Australia’s national digital government index ranking (5th in the OECD) and strategies like the federal Digital Economy Strategy provide a supportive backdrop for all states. Perth benefits from a collaborative approach: local initiatives tailored to WA’s strengths, complemented by national programs and inter-state knowledge exchange.

Challenges and Opportunities

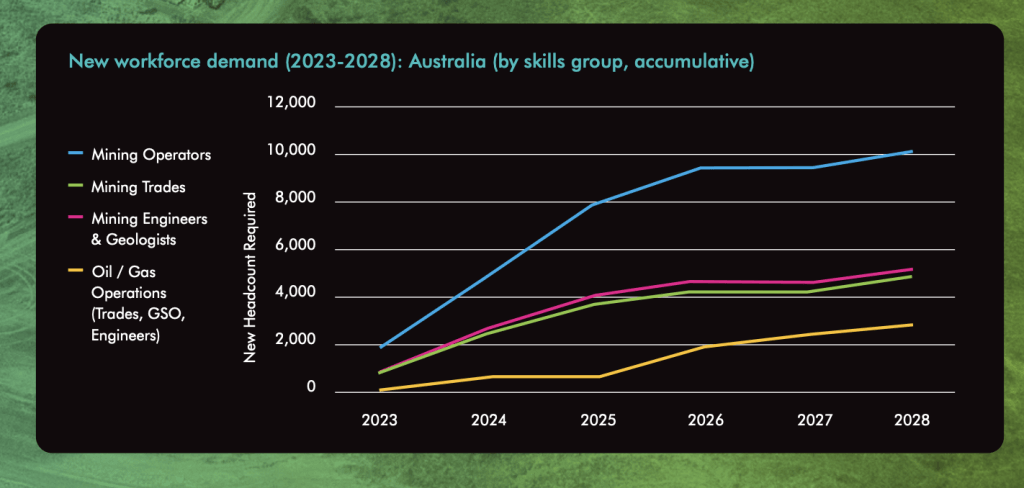

Perth’s journey is not without challenges. A prominent hurdle is the skills gap – the rapid adoption of AI, IoT, and automation means demand for tech-skilled workers is outstripping supply.

Australia will need an extra 100,000 tech workers by 2024 to meet digital growth, with the resources sector facing a significant share of that demand. WA’s remote location can make talent attraction harder compared to Sydney or Melbourne.

Both industry and government are addressing this through training, migration, and making the sectors more inclusive (BHP’s Perth IROC notably achieved a nearly 50% female workforce, highlighting diversity gains through new job types [2]).

Another challenge is ensuring SME participation: many small Perth manufacturers lag in digital adoption due to cost and expertise barriers – 44% of Australian manufacturing businesses surveyed had not introduced any new technology in the last year. Financial constraints were cited by 36% of firms as the top barrier to digital transformation, followed by limited time and skills. To address this, WA offers grants and the federal government provides tax incentives for digital investment by small businesses.

The digital transformation of mining and manufacturing in Perth is unlocking new economic streams. The METS sector is a prime example – valued at an estimated $27 billion contribution to WA’s economy, it has grown as local companies develop software, sensors, and engineering solutions now exported globally.

Perth’s reputation in this field attracts international investment. Additionally, efficiency gains from digital technology improve productivity – one report valued potential productivity improvements from digital innovation in mining at up to 23%.

For manufacturing, embracing advanced technologies can help higher-value products be made locally, reducing reliance on imports and creating skilled jobs. WA’s strategy of focusing on green energy technology manufacturing positions Perth to benefit from the worldwide energy transition.

If Perth continues on this path, it could not only catch up to other states in diversified industry output but become a center of excellence in select high-tech fields – securing a prominent role in Australia’s overall digital economy.

Economic and Workforce Impact

The economic and workforce impacts of digital transformation in Perth’s mining and manufacturing are profound.

Economic Growth

Technology adoption has helped WA maintain strong economic performance. Western Australia’s domestic economy grew by 5.3% in 2023-24, more than twice the national growth rate of 2.4% [12]. The state’s Gross State Product for 2023-24 reached A$455.7 billion [13].

Digital-driven productivity has played a role in this growth. In mining, automation and analytics have enabled more output with the same input, contributing to record production volumes without commensurate labor increases. Rio Tinto’s autonomous haulage system allowed its Pilbara mines to haul a quarter more material with improved safety.

Across the sector, continual improvements in efficiency are crucial as ore grades decline and operations become more remote, and digital tools are delivering those gains. In manufacturing, firms that invested in digital technology report stronger performance and resilience.

Advanced manufacturers in WA tend to be export-focused and competitive in niche markets, bringing new revenue into the state. The spillover effect of digital innovation is significant – knowledge from mining’s digital uplift is transferring to other industries, creating benefits across the economy. This cross-pollination helps diversify WA’s economic base.

Jobs and Workforce Dynamics

Fears that automation would eliminate jobs have not materialised in Perth’s mining sector – employment has grown alongside technology adoption.

The WA resources industry’s workforce expanded significantly over the past two decades, growing by 24% from 2018 to 2023. However, recent data shows a 17.6% decline from May 2023 to May 2024. Despite this recent downturn, the current workforce of 144,900 is still substantially larger than it was in the early 2000s, with projections indicating continued growth in the coming years [14].

Many of the new roles are higher-skilled. The Minerals Council of Australia observes that while some traditional roles are displaced, “many new highly skilled, highly paid roles are being created and other roles are being enhanced by technology” [15].

Automation has reduced the number of people needed in certain hazardous on-site jobs, but it has created new jobs in Perth such as remote equipment operators, data analysts, and maintenance planners.

The workforce is evolving: According to the Minerals Council of Australia, nearly 66% of Australia’s mining workforce holds a Certificate III level qualification or higher, with over 25% possessing a Bachelor’s degree or higher. This high level of qualification reflects the industry’s increasing demand for skilled workers and its strong utilisation of vocational education and training programs [16].

WA companies are investing in reskilling programs – retraining truck drivers to become remote operations controllers or drilling technicians to become robotics maintenance specialists. Industry and universities collaborate through initiatives like traineeships in automation and courses in mining data analytics.

Digital transformation has improved workforce diversity and accessibility. Remote operations centers in Perth allow more flexible rosters, which has helped attract more women into mining roles and enabled older or mobility-impaired experts to contribute off-site. BHP’s remote operations team in Perth is nearly half female and includes Indigenous employees, a notable shift in a traditionally male-dominated industry [2].

In manufacturing, the workforce impact is similarly about upskilling. Automation can handle repetitive tasks, but humans are needed to manage and maintain these systems. The Australian Manufacturing Workers’ Union in WA has supported training programs for members to learn robot programming and CNC machining.

The Manufacturing Workforce Plan 2024 emphasises equipping workers with digital skills and integrating more apprentices into high-tech fields like mechatronics. The push toward digital has also begun to make manufacturing more attractive to younger workers who are digitally savvy.

SMEs face challenges in finding employees with the right skill set due to competition with mining and technology sectors for software engineers and data specialists. Government grants are encouraging companies to engage graduates and interns on digital projects to build that talent pipeline.

Productivity and Wages

Digital transformation is boosting productivity, which can lead to higher wages and better job quality.

According to a report by A.T. Kearney, digital technologies can improve mining profits by 20 to 45 percent within two to three years. The report outlines various digital applications and their expected value, including a 3-5% recovery improvement through machine learning optimisation, a 10-20% increase in throughput by optimising energy consumption, and a 2% utilisation increase through predictive maintenance and optimised scheduling [17].

Higher productivity supports the high wages that WA’s resource sector is known for and justifies new capital investments. In manufacturing, companies that integrated IoT and automation often see reductions in waste and production time; some WA factories have reported double-digit percentage improvements in output after implementing Industry 4.0 upgrades.

These efficiency gains help firms remain globally competitive despite Australia’s relatively high labor costs, thereby securing jobs that might otherwise be offshored.

Workers in digitally advanced operations tend to earn more due to their specialised skills – a technician maintaining automated machinery or a data analyst commands a higher salary than a manual machine operator, reflecting the higher value-add of their role.

Workforce Challenges

The transition isn’t without friction. The rapid pace of change creates a continuous need for retraining. Organisations worry about “future-proofing” their staff – ensuring current employees can work with new AI or IoT systems.

Roles like data scientists and automation specialists will become core alongside traditional mining engineers, calling for strong STEM education pipelines in WA. There is also the human factor of change management: some workers may resist new technologies out of fear for job security or the disruption of learning new tools.

Companies like Rio Tinto and BHP have engaged in change management programs to involve workers early when introducing technology, emphasising safety benefits and upskilling opportunities.

Looking at the broader picture, according to a report by EY on ‘The Future of Work: the Changing Skills Landscape for Miners,’ a significant majority of jobs in the mining industry will be impacted by technology by 2030. In Mining Operations, 83% of unique occupations are expected to be either enhanced (38%) or redesigned (45%) due to technological advancements, with only 17% likely to be fully automated. This indicates that almost every role in the mining sector will evolve in response to new technologies [18].

The positive message is that most of these jobs are not eliminated but transformed – for example, a maintenance worker now uses augmented reality glasses to service equipment with remote expert guidance, rather than doing all diagnostics manually.

Perth’s experience shows that digital transformation can drive economic growth and job creation but requires a proactive approach to workforce development. The region is cultivating a high-skill workforce to support its high-tech mining and manufacturing base, aiming to create a virtuous cycle: skilled workers enable more innovation, which attracts investment and generates more skilled jobs.

Conclusion

Perth’s mining and manufacturing industries are navigating a transformative period defined by rapid technological change. Automation, AI, IoT, blockchain, cloud computing, and data analytics are operational realities delivering tangible benefits in Western Australia – from driverless trucks hauling iron ore in the Pilbara to AI algorithms fine-tuning production lines in Perth factories.

These advancements have positioned Perth as a leader in digital mining and an emerging player in advanced manufacturing, showcasing how a resource-driven economy can innovate and diversify. The transformation is backed by strong government and industry collaboration, evidenced by strategic initiatives and significant R&D investment.

Perth’s journey offers valuable insights. Leveraging unique local strengths – mining expertise – can catalyse broader digital innovation across sectors. Workforce impacts must be actively managed: Perth has shown that with reskilling and education, digital transformation can be a net positive for jobs, creating roles that are safer, more skilled, and more inclusive. Challenges such as cybersecurity and infrastructure require continuous attention.

Perth leads in areas like autonomous mining and remote operations, while also recognising the need to accelerate manufacturing digitisation to remain competitive nationally. The opportunities on Perth’s horizon are significant. In mining, integrating technologies like AI, digital twins, and robotics promises to unlock deeper efficiency and maintain WA’s world-class status.

In manufacturing, embracing advanced materials, 3D printing, and smart factories could see Perth producing high-value products at scale. Policy settings and economic trends are favorable for those who innovate.

By continuing on its digital transformation trajectory, Perth aims to build a resilient, diversified economy that secures its prosperity in the digital age – an economy where mines run with precision from city command centers, factories adapt in real-time via AI, supply chains are transparent and secure via blockchain, and a skilled workforce thrives in the jobs of the future.

References

[1] Government of Western Australia. Diversify WA 2024 Update. 2024. Available from: https://www.wa.gov.au/government/publications/diversify-wa-2024-update

[2] International Mining. BHP’s WAIO celebrates a decade of its Perth IROC. 2023 Jan 19. Available from: https://im-mining.com/2023/01/19/bhps-waio-celebrates-a-decade-of-its-perth-iroc/

[3] BBC News. Rio Tinto’s autonomous fleet expansion in the Pilbara. 2024. Available from: https://www.bbc.com/news/articles/cgej7gzg8l0o

[4] Process Online. New robotics and automation precinct opens in WA. 2024. Available from: https://www.processonline.com.au/content/factory-automation/news/new-robotics-and-automation-precinct-opens-in-wa-103083616

[5] ABB. The most digitally connected mine – Gold Fields’ Granny Smith in Australia. 2023. Available from: https://new.abb.com/industrial-software/industry-software-best-practices/mining-software/the-most-digitally-connected-mine—gold-fields-granny-smith-in-australia

[6] Reuters. BHP completes first blockchain copper concentrate trade with Minmetals. 2021 Dec 14. Available from: https://www.reuters.com/technology/bhp-completes-first-blockchain-copper-concentrate-trade-with-minmetals-2021-12-14/

[7] CCN. Western Australia’s mining companies urged to adopt blockchain technology. 2023. Available from: https://www.ccn.com/western-australias-mining-companies-urged-adopt-blockchain-technology/

[8] Mining News. Cybersecurity: mining business imperative, soon legal obligation. 2024. Available from: https://www.miningnews.net/miners/news-analysis/4375466/cybersecurity-mining-business-imperative-soon-legal-obligation

[9] Austcorp Executive. Industry 4.0 technologies reshaping landscape of future manufacturing workforce. 2025 Jan. Available from: https://www.austcorpexecutive.com.au/blog/2025/01/industry-4-technologies-reshaping-landscape-future-manufacturing-workforce

[10] The Australian Industry Group. Technology adoption in Australian industry 2024. 2024. Available from: https://www.aigroup.com.au/globalassets/news/reports/2024/research-and-economics/ai_group_technology_adoption_in_australian_industry_2024.pdf

[11] Packaging News. Production businesses embracing AI, ML and IoT. 2024. Available from: https://www.packagingnews.com.au/automation-and-robotics/production-businesses-embracing-ai-ml-and-iot

[12] Government of Western Australia. WA’s stand-out economic performance continues in 2023-24. 2024 Sep 4. Available from: https://www.wa.gov.au/government/media-statements/Cook-Labor-Government/WA’s-stand-out-economic-performance-continues-in-2023-24–20240904

[13] CEIC Data. GDP: Western Australia. 2024. Available from: https://www.ceicdata.com/en/australia/sna08-gross-domestic-product-and-gross-domestic-product-per-capita-by-state/gdp-western-australia

[14] Resource and Energy Workforce Forecast 2023-2028. Available from: https://www.areea.com.au/wp-content/uploads/2023/09/20230901_AREEA_Resources_Workforce_2023-2028.pdf

[15] The Digital Mine. Available from: https://minerals.org.au/wp-content/uploads/2022/12/The-Digital-Mine_2022.pdf

[16] Minerals Council of Australia. Available from: https://www.education.gov.au/system/files/documents/submission-file/2023-04/AUA_tranche3_Minerals%20Council%20of%20Australia.pdf

[17] AT Kearney. Using Digital Technologies to Uncover Value in Mining. Available from: https://www.kearney.com/documents/291362523/291366756/Using+Digital+Technologies+to+Uncover+Value+in+Mining.pdf/ddc9e145-ba25-2808-eeaa-959d67aa9b11?t=1615853352000

[18] Mineral Council of Australia. The Future of Work:the Changing Skills Landscape for Miners. Available from: https://minerals.org.au/wp-content/uploads/2022/12/The-Future-of-Work-The-Changing-Skills-Landscape-for-Miners-February-2019.pdf